Investors' Worst Fears Continue to Weigh on Dow

Three demoralizing developments have forced the stock market to its knees in recent weeks, as the level of fear for investors ticked upward and the major indexes slumped over 5%. The old stock market saying, "Sell in May and go away," could not seem closer to the truth given the near uniform collapse of the Dow Jones Industrial Average (INDEX: ^DJI) , S&P 500 (INDEX: ^GSPC) , and Nasdaq (INDEX: ^IXIC) indexes since May 1.

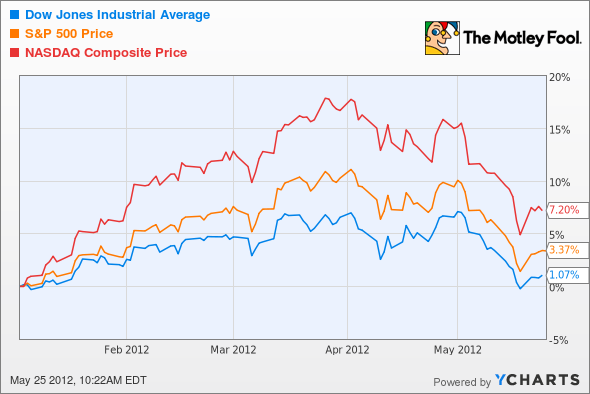

Through the month of March, all three seemed poised to deliver record returns for investors, gaining an average of 11% across the board during that time frame. April was basically a wash, however, and May has been utterly dismal. The chart below illustrates this devastating decline.

Dow Jones Industrial Average data by YCharts

At this point, the underlying reasons for this collapse have become all too familiar. In fact, it would be hard to think of a worse sequence of events that would rehash the gut-wrenching market events of the past decade or so.

First off, the convoluted European saga continues to depress markets around the world, lingering on like a gloomy guest at an otherwise boisterous dinner party. At this point, the austerity requirements for Greece would cut so deep that the country will probably be extracted from the euro experiment altogether. It's only fitting, perhaps, that one of the smallest players in this tragic drama could yet lead to the demise of the currency in a domino-like fashion. Nevertheless, investors seem to be sitting on the sidelines to watch how this plays out.

As we recoil from the Greek tragedy, investors faced another unpleasant surprise in recent weeks when JPMorgan Chase (NYS: JPM) revealed substantial trading losses in its chief investment office. Whether the amount is $2 billion or $5 billion is irrelevant, since the utter lack of visibility into the trades granted by leadership brings to mind the worst memories of the 2008 financial crisis. So much for placing systemic banking risks in the rearview mirror.

Finally, the most recent blow to investor confidence arrived last week in the shape of an ill-conceived Facebook (NAS: FB) IPO. The debacle unfolded in the following sequence: Facebook amended its IPO filing just days before the debut to note slower growth in advertising, the company issued shares at the high end of the IPO pricing range, and the stock fell substantially in the first three days of trading. Not surprisingly, lawsuits emerged from all angles, claiming insider information was delivered to the most powerful players on Wall Street, while the retail investors were left in the dust. While Fellow Fool Morgan Housel points out that chasing a fast buck was never a good idea, this stock offering still reeks of foul play.

Each of these events shocked the markets, and investors are reminded in one fell swoop of the financial crisis, the failed currency experiments, and the IPO bubbles that have crushed our confidence repeatedly over the past 15 years. The most logical response to all of this turmoil is a flight to so-called "risk-free" assets like Treasuries for many investors. With yields hitting record lows, however, is there a more attractive way to ride out the market? One could do worse than invest in high-yielding stocks, and your first move should be to read our recent special report, "Secure Your Future With 9 Rock-Solid Dividend Stocks." In the midst of a roller-coaster market, these stocks offer stability in the form of cold, hard cash.

At the time thisarticle was published Isaac Pino has no positions in the stocks mentioned above. The Motley Fool owns shares of JPMorgan Chase. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.