How High Can Edison International Fly?

Shares of Edison International (NYS: EIX) hit a 52-week high today. Let's look at how it got here and whether clear skies are ahead.

How it got here

The regulated utility business is usually a slow and steady moneymaker for investors, but Edison International has beaten expectations pretty soundly in the last year. The company beat earnings estimates in the final three quarters of 2011, and only missed estimates in the first quarter because regulators haven't made a final decision on rates at Southern California Edison.

On a valuation basis, Edison International trades at 15 times earnings and has a nice 2.9% dividend yield. It isn't the best yield in the industry, but with earnings still growing, it is a nice kicker for investors.

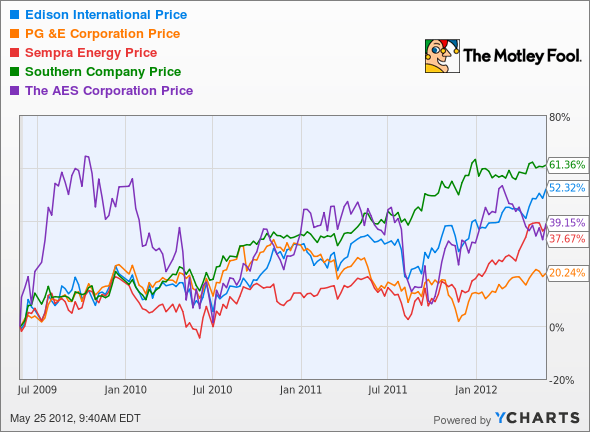

Performance of utilities has been fairly strong as the economy recovers. Southern Co. (NYS: SO) and AES (NYS: AES) , which operate in a variety of domestic and international markets, are closing in on 52-week highs as well. The competition in California, coming from Sempra Energy (NYS: SRE) and PG&E (NYS: PCG) , has also performed well with both reaching new highs.

Compared to these California utilities, Edison's dividend yield and forward P/E ratio both fall short, but the company grew slightly faster than both competitors recently.

Edison International | 2.5% | 2.7% | 2.9% | 17.25 |

PG&E | 2.5% | 1.2% | 4.2% | 14.2 |

Sempra Energy | 3.4% | (2.1%) | 3.2% | 14.8 |

Source: Yahoo! Finance.

The numbers above aren't going to blow any investors out of the water, but that's what utilities are all about. If you want a strong dividend and a safe bet, these companies might be for you.

What's next?

Edison International does not blow me away on either a valuation or yield standpoint. Given the slow economic recovery, I wouldn't expect demand to increase much, if at all, and given the regulated nature of some of Edison's business, that means earnings will be fairly flat, but consistent.

CAPS member agree, giving the stock a ho-hum three-star rating. Depending on your risk profile, this could be a great stock; the dividend yield just isn't enough to entice me right now.

Interested in reading more about Edison International? Click here to add it to My Watchlist, and My Watchlist will find all of our Foolish analysis on this stock.

At the time thisarticle was published Fool contributorTravis Hoium. You can follow Travis on Twitter at@FlushDrawFool, check out hispersonal stock holdingsor follow his CAPS picks atTMFFlushDraw. Motley Fool newsletter services have recommended buying shares of Southern. The Motley Fool has a disclosure policy.

We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.