My Money Is on This Entertainment Company

Last summer, I took a giant leap of faith. Instead of suggesting where to invest -- and then never revisiting my original thesis -- I pledged to put my own money behind 10 stocks. My goal was to build the World's Greatest Retirement Portfolio -- and attempt to hold the stocks for at least three years. Almost one year through, and the portfolio is dominating the S&P 500 -- outperforming the index by 18 percentage points!

Today, I'm happy to state that after almost a year, I'm just as bullish on one of those 10 -- Activision Blizzard (NAS: ATVI) -- as I was a year ago. I'll show you how my pick has performed, why I'm still bullish, and what I see moving forward for the company. At the end, I'll offer you access to a special free report that has three more ideas for the perfect retirement portfolio.

Reviewing my thesis

There were three big reasons behind my original recommendation of Activision Blizzard. The first was the fact that the company was transitioning to a subscription-based model that provided much steadier streams of revenue. As far as subscriptions go, results have been mixed. The Blizzard side of the company famously lost thousands of subscribers over the past year. That has been somewhat mitigated by the Activision side of the company offering a popular subscription model to the Call of Duty Elite franchise.

The second reason I was bullish on Activision was the company's opportunities abroad. Chinese Internet juggernaut Sohu.com (NAS: SOHU) set up a subsidiary solely for the purpose of gaming -- Changyou -- so there's some serious competition in Asia. Things, however, seem to be going well there for Activision. In order to counter Sohu and distribute its content abroad, Activision recently renewed an agreement with NetEase (NAS: NTES) -- which has access to 480 million users in Asia -- for another three years.

Finally, I was a big fan of the company's rock-solid balance sheet. Nothing has changed there, as Activision has a balance sheet that sports $3.5 billion in cash and no debt.

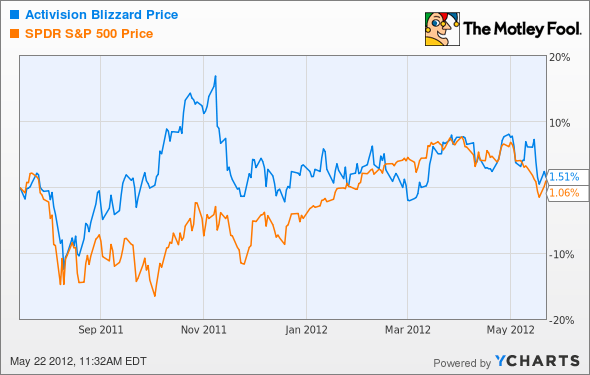

When you take the see-saw of these three factors into account, and include the company's dividend, a $4,000 investment has returned about $150, as opposed to the roughly $70 an investment in the S&P 500 would have gotten.

Why I'm still bullish

I'll be the first to admit, the defection of subscribers from the World of Warcraft franchise was concerning -- but Activision Blizzard is more than a one-trick pony. The company recently released what hopes to be the next big online game: Diablo III. Though there may have been initial hiccups with providing the game to users, demand is there, and I expect it to show up on the company's income statement. Then, of course, there's always the latest iteration of Call of Duty to look forward to.

Furthermore, I'm encouraged by the company's continued attempts to take the Activision side of its business -- which has traditionally focused on making games for consoles -- toward a subscription model that guarantees steadier revenue streams. I'm also heartened by the fact that though Electronic Arts (NAS: EA) tried to dethrone World of Warcraft with its Star Wars: The Old Republic, the jury of gamers seems to have sided with World of Warcraft.

Finally, though I don't think mobile gaming specialists like Zynga (NAS: ZNGA) pose a huge threat to Activision -- playing on a computer or console is fundamentally different than playing a game on a mobile device -- it's nice to hear rumors about the company considering an entrance into the sphere. Whether it happens or not isn't exactly fundamental to my thesis, but it's something to keep an eye on.

A solid bet for your retirement

You know where I'm putting my money, but if you aren't the gaming type and still want suggestions for your retirement portfolio, I suggest you check out our latest special free report: 3 Stocks That Will Help You Retire Rich. Inside, you'll get the names of three stalwart business that promise to be dominating their fields -- and rewarding shareholders -- for years to come. Get your copy of the report today, absolutely free!

At the time thisarticle was published Fool contributor Brian Stoffel owns shares of Activision Blizzard. You can follow him on Twitter, where he goes by TMFStoffel.The Fool owns shares of and has written calls on Activision Blizzard. Motley Fool newsletter services have recommended buying shares of Activision Blizzard, Sohu.com, and NetEase, and creating a synthetic long position in Activision Blizzard. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.