1 Huge Buy Signal for Would-Be Google Investors

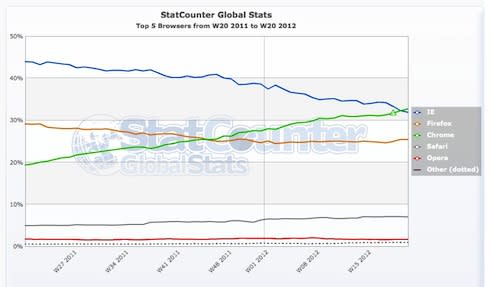

Two months after Foolish colleague Evan Niu predicted that Google's (NAS: GOOG) Chrome would unseat Microsoft's (NAS: MSFT) Internet Explorer as the top dog among browsers, it's happened. New data from StatCounter shows Chrome with a 32.76% share versus 31.94% for IE.

Words can't fully describe what this means:

See the pattern here? Not only is IE losing share -- and rapidly -- but other browsers are also on a fast track to nowhere, including Apple's (NAS: AAPL) Safari. Think about that for a second. Even as the Mac has defied a slowdown in the global PC market, Chrome has risen in popularity. The implication? Mac users are using Chrome at least as much as (or perhaps even more than) Apple's native browser.

And that's what makes Chrome's rise so interesting -- a buy signal, even. Safari is a good browser. It's fast, it's as secure as peers, and it does a terrific job of rendering video. Why would any Mac user choose Chrome? Because Google's browser is always going to be better at running the code that makes Google's various apps function.

I'm talking specifically about Gmail, Calendar, and the various piece parts of the Google Apps suite that has proved popular among corporate and government clients. Recent wins include drugmaker Roche and the U.S. Department of the Interior. More than 4 million businesses are using the Google-y suite for business as of this writing.

To my mind, there's little doubt where Google is headed with Chrome. The Big G wants its search engine and browser to be our on-ramp to the Web, with apps accounting for an increasing amount of our usage, adding still more information to the world's richest account of our lives on the Web. It's an archive that dwarfs even Facebook (NYS: FB) , and it's worth buying at current prices. And although some observers think Facebook represents Google's greatest threat, our senior technology analyst thinks he's identified one better way to play the social-media boom. He details exactly why the smart money's heading elsewhere in the massive growth sector in our new research report, which you can access in our new research report.

Think I'm wrong? Do you find Google too volatile a stock for your portfolio? Fair enough. There are plenty more options for safe growth, including these nine rock-solid dividend payers.

At the time thisarticle was published Fool contributorTim Beyersis a member of theMotley Fool Rule Breakersstock-picking team and the Motley Fool Supernova Odyssey I mission. He owned shares of Apple and Google at the time of publication. Check out Tim'sWeb home,portfolio holdings, andFoolish writings, or connect with him onGoogle+or Twitter, where he goes by@milehighfool. You can also get his insightsdelivered directly to your RSS reader.The Motley Fool owns shares of Microsoft, Apple, and Google.Motley Fool newsletter serviceshave recommended buying shares of Google, Microsoft, and Apple and creating bull call spread positions in Apple and Microsoft. The Motley Fool has adisclosure policy. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.