How High Can Colgate-Palmolive Fly?

Shares of Colgate-Palmolive (NYS: CL) hit a 52-week high today. Let's take a look at how it got there and see whether clear skies are still in the forecast.

How it got here

Rule numero uno of uncertain economic times is to flock to points of safety. Luckily for the consumer staples sector, there are few investments safer than companies that generate huge amounts of cash while selling necessities that tend to have only minor fluctuations even during times of market panic.

That's one reason we're seeing such tremendous resilience in consumer goods names Colgate-Palmolive, Johnson & Johnson (NYS: JNJ) , Procter & Gamble (NYS: PG) , and Unilever (NYS: UL) relative to the recent market weakness.

What's more, this strength comes in light of marginally weaker earnings from some of these behemoths. Procter & Gamble recently warned it would be lowering prices on some of its products and taking a temporary hit to its margins in order to recapture market share from its rivals. Colgate-Palmolive's recent quarterly report highlighted in-line earnings, but also pointed to shrinking margins. Unilever and Johnson & Johnson were the exception to the rule, with both sailing past Wall Street's expectations.

Another aspect driving these names higher is their premier dividends. Strong cash flow and necessity goods are a good combination for a growing dividend, and investors are willing to pay a premium for that kind of safety.

How it stacks up

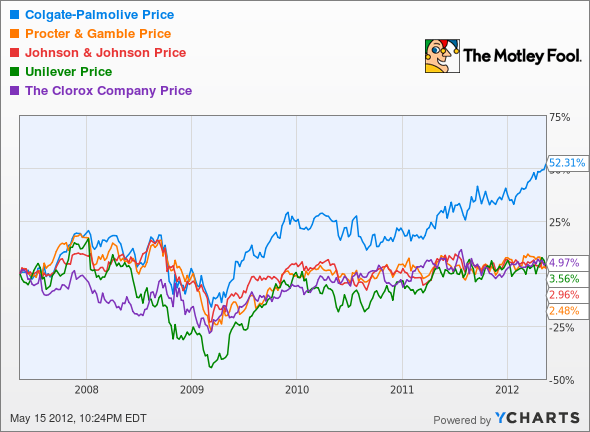

Let's see how Colgate-Palmolive stacks up next to its peers.

As you can see from the above, none of these consumer staple stocks are big movers, but Colgate-Palmolive has vastly outperformed its peers. That could have something to do with its market share rising in eight of 12 business segments in the first quarter. Now let's dig a little deeper.

Company | Price/Book | Price/Cash Flow | Forward P/E | Dividend Yield | Consecutive Years Raising Dividend |

|---|---|---|---|---|---|

Colgate-Palmolive | 21.5 | 17.5 | 17.4 | 2.5% | 49 |

Johnson & Johnson | 2.8 | 11.9 | 11.6 | 3.8% | 50 |

Procter & Gamble | 2.7 | 14.4 | 15.3 | 3.5% | 56 |

Unilever | 5.4 | 13.7 | 13.9 | 3.8% | 12 |

Clorox (NYS: CLX) | N/M | 14.9 | 16.1 | 3.5% | 35 |

Source: Morningstar, Yahoo! Finance, Dynamic Dividend, Dividata; yields are projected; N/M = not meaningful.

I'm aware this is a lot of data to try to absorb, but the key point is those very last two columns: the dividend and the consecutive years that each respective company has raised that dividend. Now you can see the luxury of what selling necessity goods does -- it allows for near-guaranteed cash flow that's only marginally affected by inflation.

Outside of Unilever, which moved from a semiannual to a quarterly payout in recent years, the remaining four are among the leading dividend aristocrats. Very few companies have extended the streak of increasing their quarterly payouts more than P&G, J&J, and Colgate-Palmolive. Even Clorox, which sells basic cleaning products, has seen its fair share of increases at 35 straight years.

Perhaps the one differentiating factor between these companies is their debt levels. If you notice from the statistics above, Clorox actually carries so much debt that it translates over into negative shareholder equity (although good luck trying to make a case that Clorox's cash flow isn't strong enough to support its debt levels). Colgate-Palmolive's debt-to-equity is also a very high 199% when compared to J&J's 32%. Again, this isn't a very big deal, but it is a noticeable difference.

What's next

Now for the real question: What's next for Colgate-Palmolive? That question is going to depend on whether it continues to take market share from its peers, whether it can keep its debt levels under control, and whether it can maintain the pricing power required to pass along price increases to consumers as market conditions merit.

Our very own CAPS community gives the company a highly coveted five-star rating, with an overwhelming 96.2% of members who've rated it expecting it to outperform. Although I have yet to make a CAPScall on Colgate-Palmolive in either direction, my tendency is to lean toward rating it an as outperform.

The primary reason I've held back is due to valuation. There's little arguing against any of these five stocks as their products are predominantly necessity items that allow them to boost prices and maintain cash flow regardless of economic conditions. However, Colgate-Palmolive's highly levered position relative to P&G and J&J is enough for me to hold back on choosing it as an outperform. Following a pullback of 10%-15%, I am more than willing to add it to my CAPS portfolio for the long run.

Consumer staples are without a doubt a safe-haven investment. If you'd like the inside scoop on more great tips to help you reach your retirement goals, then simply click here and our latest special report is yours... for free!

Craving more input on Colgate-Palmolive? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool owns shares of Johnson & Johnson and Clorox. Motley Fool newsletter services have recommended buying shares of Johnson & Johnson, Procter & Gamble, and Unilever, as well as a diagonal call position in Johnson & Johnson. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.