The 1 Chart Bond Investors Need to Worry About

According to the Investment Company Institute, $215 billion has flooded into bond mutual funds over the last year. Add in the amount invested into exchange-traded funds, and it's even greater.

With interest rates at all-time lows, what are these people thinking? They've been burned by stocks twice in the last decade, and think they're safer in bonds. Even though bonds yield close to nothing, at least they'll get their money back, the thought likely goes.

But that's probably not the case. Not only do bonds yield a measly amount, but after you add in inflation, the yield is negative in many cases.

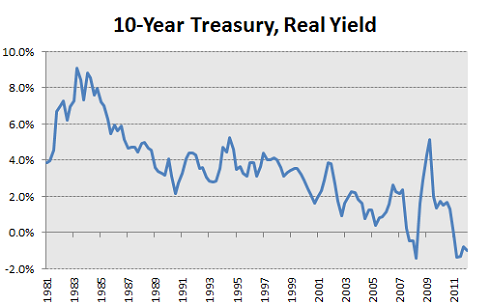

Take the benchmark 10-year Treasury bond. This chart shows its yield minus the annual rate of inflation (or the "real" yield):

Source: Federal Reserve, author's calculations.

No way to sugarcoat this: Unless inflation plunges, or interest rates fall even more than they already have (both unlikely), you will likely lose money on your bond investments. If not in actual dollar terms, then in purchasing-power terms.

Here's what Warren Buffett said about it in this year's Berkshire Hathaway (NYS: BRK.B) shareholder letter:

Most of these currency-based investments are thought of as 'safe.' In truth they are among the most dangerous of assets. Their beta may be zero, but their risk is huge. Over the past century these instruments have destroyed the purchasing power of investors in many countries, even as the holders continued to receive timely payments of interest and principal. This ugly result, moreover, will forever recur. Governments determine the ultimate value of money, and systemic forces will sometimes cause them to gravitate to policies that produce inflation. From time to time such policies spin out of control. Even in the U.S., where the wish for a stable currency is strong, the dollar has fallen a staggering 86% in value since 1965, when I took over management of Berkshire. It takes no less than $7 today to buy what $1 did at that time. Consequently, a tax-free institution would have needed 4.3% interest annually from bond investments over that period to simply maintain its purchasing power. Its managers would have been kidding themselves if they thought of any portion of that interest as 'income.'

If you're about to retire and can't afford an ounce of volatility from stocks, bonds might be the right move. For everyone else, there are options. Good, high-quality companies like Johnson & Johnson (NYS: JNJ) , Coca-Cola (NYS: KO) , and Procter & Gamble (NYS: PG) have dividend yields significantly higher than the yield on Treasury bonds, have been making dividend payments for decades, and grow their dividends year after year, usually at a rate faster than inflation.

For some more ideas, check out The Motley Fool's special report, "Secure Your Future With 9 Rock-Solid Dividend Stocks." It's free. Just click here.

At the time thisarticle was published Fool contributor Morgan Housel owns shares of Berkshire, Johnson & Johnson, and Procter & Gamble. Follow him on Twitter @TMFHousel. The Motley Fool owns shares of Johnson & Johnson and Coca-Cola. Motley Fool newsletter services have recommended buying shares of Coca-Cola, Procter & Gamble, and Johnson & Johnson. Motley Fool newsletter services have recommended creating a diagonal call position in Johnson & Johnson. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.