How Low Can MAKO Surgical Go?

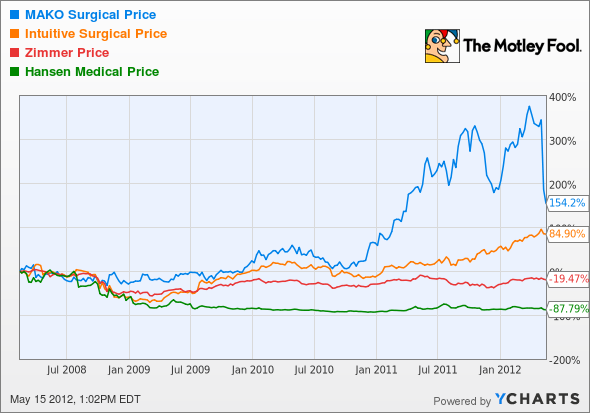

Shares of MAKO Surgical (NAS: MAKO) hit a 52-week low yesterday. Let's look at how it got here and see whether dark clouds lie ahead.

How it got here

There's exactly one reason MAKO is where it's at right now: one disappointing earnings release. Just one. The company reported first-quarter figures last week and missed expectations on revenue as RIO systems sales fell short. The company sold only six systems, which caused management to tone down its full-year forecast on how many it expected to sell.

On the bright side, its procedure guidance remained unchanged and MAKO still expects between 11,000 and 13,000 revenue-generating MAKOplasty procedures to be performed this year. Shares had touched an all-time high of $45.15 just six weeks ago, meaning that yesterday's 52-week low of $21.18 represents a gut-wrenching 53% decline.

That puts shares lower than they were a year ago. Yet trailing-12-month sales are up 82% from a year ago, and the commercial installed base of RIO systems has grown by almost 60%. TTM MAKOplasty procedures performed are also up 95%, although, on the flip side, the company's TTM net loss has narrowed by only 4%.

MAKO's actual business -- you know, that thing that investors should care about -- continues to grow. There's no doubt the quarter was a disappointment, but this sell-off is simply overdone.

How it stacks up

Let's see how MAKO stacks up with some of its medical-device rivals and peers.

Let's add some more fundamental metrics for deeper insight.

Company | P/S (TTM) | TTM Sales Growth | Net Margin (TTM) | ROE (TTM) |

|---|---|---|---|---|

MAKO Surgical | 10 | 82% | (40.5%) | (35.4%) |

Intuitive Surgical (NAS: ISRG) | 11.7 | 26.6% | 28.7% | 20.7% |

Zimmer Holdings (NYS: ZMH) | 2.4 | 4.8% | 17% | 13.2% |

Hansen Medical (NAS: HNSN) | 6.7 | 12% | (187%) | (118.3%) |

Source: Reuters. TTM = trailing 12 months.

While MAKO is working to disrupt traditional larger rivals like Zimmer Holdings and its orthopedic reconstructive devices, Intuitive Surgical and Hansen Medical loosely represent the two extreme outcomes that MAKO is headed toward. Intuitive Surgical is the role model with its da Vinci robots to aspire toward, while Hansen Medical shows how disastrous it can be if adoption fails to take off, as its Sensei systems sales have languished (only two last quarter).

What's next?

This quarter's disappointing RIO sales are sparking similar fears, but I think it's premature to jump to any conclusions. One bad quarter doesn't unravel MAKO's long-term story -- this dip is a buying opportunity.

Use our free Watchlist service to get the latest updates on these medical-device companies.

Add MAKO Surgical to My Watchlist.

Add Intuitive Surgical to My Watchlist.

Add Hansen Medical to My Watchlist.

Add Zimmer Holdings to My Watchlist.

At the time thisarticle was published Fool contributorEvan Niuowns shares of MAKO Surgical, but he holds no other position in any company mentioned. Check out hisholdings and a short bio. The Motley Fool owns shares of Intuitive Surgical, MAKO Surgical, and Zimmer Holdings.Motley Fool newsletter serviceshave recommended buying shares of MAKO Surgical and Intuitive Surgical. The Motley Fool has adisclosure policy. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.