How Low Can Intrepid Potash Go?

Shares of Intrepid Potash (NYS: IPI) hit a 52-week low yesterday. Let's take a look at how they got there and whether cloudy skies remain in the forecast.

How it got here

Intrepid Potash has been a victim of economic uncertainty just as much as any other globally dependent company. Intrepid, the largest producer of potash (a type of fertilizer) in the United States, has suffered from two primary issues.

First, potash prices have remained challenging. In late 2008, potash producers such as Mosaic (NYS: MOS) , PotashCorp (NYS: POT) , and Intrepid were able to command nearly $900 per ton for their fertilizing product. One year later, those prices had fallen about 65% to almost $300 per ton. Currently around $480 per ton, these potash producers are hardly struggling, but the price of potash has been relatively stagnant for more than six months and their costs of production are rising modestly. With little pricing power, these companies have to rely on higher sales volumes to drive growth.

And that leads me to the second reason Intrepid Potash has been struggling: high expectations. Last year was a record year of production for farmers, and it's going to be very difficult for them to reproduce the level of success they had in 2011. However, Intrepid did note in its latest quarterly report that crop prices and potash levels remain on track to support strong growth for the company throughout the remainder of the year.

How it stacks up

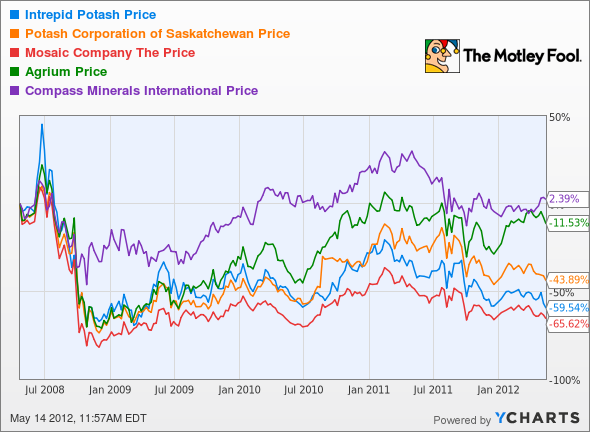

Let's see how Intrepid Potash stacks up next to its peers.

These companies have very much traded in tandem with one another. Let's look more closely at their financials to get a more detailed picture of this sector.

Company | Price/Book | Price/Cash Flow | Forward P/E | 5-Year Revenue CAGR |

|---|---|---|---|---|

Intrepid Potash | 1.7 | 8.5 | 12.4 | 23.7% |

PotashCorp | 4.1 | 11.2 | 10.6 | 18.3% |

Mosaic | 1.7 | 8.8 | 9.6 | 13.4% |

Agrium (NYS: AGU) | 1.9 | 7.1 | 8.7 | 29.8% |

Compass Minerals (NYS: CMP) | 5.1 | 14.1 | 13.1 | 10.8% |

Source: Morningstar, author's calculations, CAGR = compound annual growth rate.

Aside from Compass Minerals, whose deicing operations suffered from the warmest winter in 15 years, the remaining four potash and phosphate producers appear to be exceptional values that are taking advantage of warmer weather in the U.S.

Agrium offers the best overall valuation, as well as the fastest five-year annual growth rate. However, it should be noted that Agrium also grows predominantly through acquisitions, which definitely has an effect on its growth rate, but definitely not its relative cheapness. Agrium is the only company of these five that has seen earnings estimates on the rise over the past three months. Mosaic, PotashCorp, and Intrepid have all seen Wall Street's earnings forecasts fall as stagnant potash prices and the rising costs of production are squeezing margins. Still, all three, in addition to Agrium, offer attractive valuations.

What's next

Now for the real question: What's next for Intrepid Potash? That question is going to depend on whether crop prices remain elevated which will necessitate more potash and if Intrepid Potash can control its costs and increase sales in light of stagnant potash prices.

Our very own CAPS community gives the company a four-star rating (out of five), with a whopping 96.5% of members expecting it to outperform. Although I have yet to make a CAPScall in either direction up until now, I am now ready to enter a call of outperform on Intrepid Potash.

The company is considerably smaller than the peers noted above, which gives it the opportunity to grow much faster than its peers over the next few years and be more flexible with its production capabilities to drive down costs. This isn't to say that inclement weather won't create hiccups in farm production every now and then, but a growing population will demand more food, and Intrepid's products are conducive to growth and increasing farmers' output. It's a company that should do just fine over the long term.

If you'd like the inside scoop on three more companies that could help you retire rich, then click here for access to our latest free special report. Craving more input on Intrepid Potash? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool owns shares of Compass Minerals. Motley Fool newsletter services have recommended buying shares of PotashCorp. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.