How Low Can Best Buy Go?

Shares of Best Buy (NYS: BBY) hit a 52-week low on Friday. Let's take a look at how it got there and see whether cloudy skies remain in the forecast.

How it got here

Best Buy should be sending thank-you cards to companies like Research In Motion and Chesapeake Energy, because without them, it'd be the laughingstock of Wall Street.

Best Buy has been suffering from both internal problems and a struggling business model. Internally, former CEO Brian Dunn is under investigation for having had an improper relationship with a company intern and allegedly misusing company funds. That's a damaging blow to a management team that put their full faith behind Dunn just weeks after he unveiled a plan to turn around the company's ailing business.

The company's big-box business model is also at risk. Consumers are basically using a Best Buy store as an electronics showroom and then using deals on online retailer Amazon.com (NAS: AMZN) to buy those same products at a discount. Also hurting Best Buy has been its reliance on television sales (specifically 3-D TVs), which are seriously dragging down margins. Sony's (NYS: SNE) eight straight years of losses from its television segment should have been a clue for Best Buy to diversify its business better.

Best Buy has planned to close 50 of its larger stores in favor of 100 smaller, mobile-oriented locations in an effort to reduce costs and maximize employee efficiency. In addition, employees will soon be incentivized with sales bonuses, which I suspect will have a positive impact on sales -- however, many of my Foolish colleagues disagree.

How it stacks up

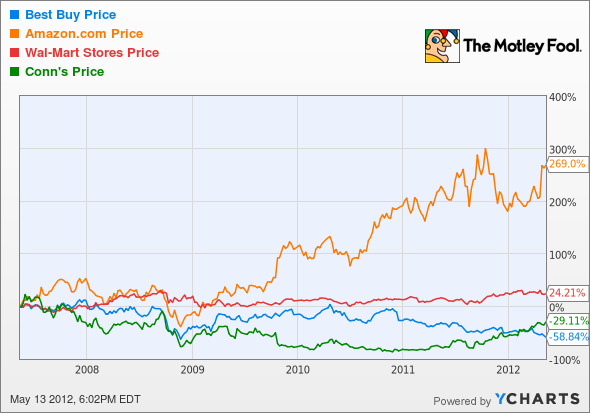

Let's see how Best Buy stacks up next to its peers.

Clearly, Amazon has been the runaway winner among electronic retailers, with its price-cutting deals and convenience being deciding factors in driving its sales higher.

Company | Price/Book | Price/Cash Flow | Forward P/E | 5-Year Revenue CAGR |

|---|---|---|---|---|

Best Buy | 1.7 | 2.1 | 4.9 | 7.1% |

Amazon.com | 14.2 | 34.5 | 88.1 | 35.0% |

Wal-Mart (NYS: WMT) | 2.8 | 8.5 | 11.3 | 5.1% |

Conn's (NAS: CONN) | 1.6 | 8.9 | 11.5 | 0.8% |

Source: Morningstar, author's calculations. CAGR = compound annual growth rate.

Don't fall over, but that is indeed correct: Best Buy is outpacing Wal-Mart in revenue growth. In fact, outside of Conn's, which has only recently turned its operations around, Best Buy, Wal-Mart and Amazon have all grown sales in each year over the past decade -- no small task considering that we experienced our worst recession in 70 years three years ago. What investors are having the toughest time with is in realizing that Best Buy is no longer a growth company; it's a value play. At just two times cash flow and roughly five times forward earnings, Best Buy investors look to be getting a legal five-finger discount (aka a steal).

What's next

Now for the real question: What's next for Best Buy? That question is going to depend on whether it can smoothly transition into a smaller-store business model and if it can truly compete with Amazon.com. It is ramping up its Internet efforts, but "Will they be enough?" is the question still to be answered. Even if Internet sales grow to $4 billion as management expects by 2016, it will still likely represent 8% or less of Best Buy's total sales.

Our very own CAPS community gives the company a dreaded one-star rating (out of five), with 20.9% of members expecting it underperform. In my usual contrarian fashion, I've been one of the few vocally optimistic Fools to rally in support of Best Buy. My current CAPScall of outperform, though, has gone in the opposite direction and is currently down 35 points. But don't look for me to close that call anytime soon.

Best Buy does have its fair share of problems; there's little denying that. But it'd be wrong to ignore that Best Buy is strongly cash flow positive and valued far below its sector peers, who arguably aren't growing that fast either (Amazon excluded). Best Buy is gearing its business to focus on higher-margin mobile and tablet products, which should help it maintain the very tight margins that make its dividend and cash flow so predictable. Throw out the Circuit City comparisons because these two businesses aren't even remotely alike, and consider Best Buy a great value play going forward.

If you'd like the inside scoop on three more companies set to take advantage of the next technological revolution, click here and you'll get free access to our latest special report.

Craving more input on Best Buy? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool owns shares of Best Buy and Amazon.com. Motley Fool newsletter services have recommended buying shares of Chesapeake Energy and Amazon.com, as well as creating a diagonal call position in Wal-Mart. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.