This Disruptive Innovator Is Entering "Screaming Buy" Territory

It's amazing how fickle the market is. Just 11 days ago, shares of IPG Photonics (NAS: IPGP) surged almost 20%. The company's earnings report demonstrated excellent execution and a still-lengthy growth runway.

Since then, there hasn't been any bad news, yet shares have dropped over 20%. Below, I'll show you why this is a company worthy of your attention and why macro-concerns shouldn't scare long-term investors away from buying in now.

The sweet spot of disruptive innovation

I bought IPG for my Roth IRA just two weeks ago. Borrowing heavily from that article, here's why IPG's fiber-optic lasers sit in the sweet spot of disruptive innovation.

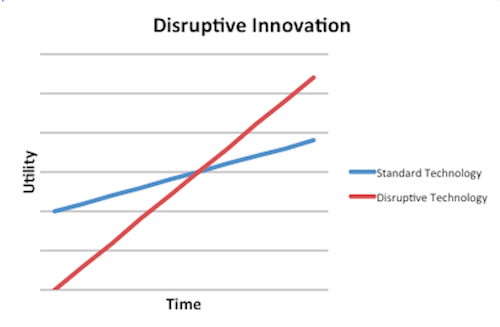

Source: Author, based on The Innovator's Dilemma by Clayton Christensen.

This is my own visual representation of an idea I learned about in Clayton Christensen's The Innovator's Dilemma. Oftentimes, smaller companies' new technologies are able to surpass those of much larger companies.

This is because newer technologies (red line) initially don't have the same utility as established technologies (blue line). This serves as a disincentive for large companies to worry about new technologies until it's too late (the intersection). Of equal importance, disruptive technology generally becomes cheaper as time goes on, while standard technology costs remain flat.

As opposed to standard carbon-based lasers (the blue line) offered by Rofin-Sinar Technologies (NAS: RSTI) and Coherent (NAS: COHR) , fiber-optic lasers have been making huge leaps in strength over the past few decades. IPG's lasers are typically less costly for its customers -- both in their asking price and the amount of energy necessary to run them.

Far from being just a cool new trend, fiber-optic laser technology is proving its advantages on the company's balance sheet. Sales grew 23% last quarter, and because profit margins expanded by 140 basis points, profit increased by 31%.

Macro concerns

So why is the company down by so much? It all comes down to worries about the global economy. In truth, these worries are well-founded; our employment picture is only improving by baby steps, growth in China appears to be slowing, and Europe is just a hot mess.

About 84% of the lasers IPG sells are used for cutting and welding large materials such as those used in the auto industry. It's well-known that when there's a global economic slowdown, the auto industry and its large-scale brethren are hit hardest. That means decreased demand for IPG's lasers and a plummeting stock price.

As if that weren't enough, the company also has high fixed costs. That's because it manufactures its own diodes. That's a great thing during boom times, as input costs are significantly lower than the competition's. But as the company states, "A high proportion of our costs [are] fixed, so they are generally difficult or slow to adjust in response to changes in demand." In other words, IPG still has to pay its diode makers -- even when business is slow -- and the competition doesn't have that problem.

Why the long-term investor shouldn't worry

Let's get one thing clear: If the global economy does slow down, IPG's stock could still have a long way to fall. If you can't stomach that kind of volatility, then this may not be the company for you.

However, if you have a 10-year-plus time horizon, I think there's little to worry about. First of all, there are some curious benefits to difficult economic times. Though IPG is a top dog in the field of fiber-optic lasers, it's no longer without competition. Newport Corporation (NAS: NEWP) and JDS Uniphase (NAS: JDSU) are just two of the many companies attempting to get in the game.

But neither of these companies is relying solely on fiber-optic lasers for revenue. Lasers accounted for just 31% of Newport's income last quarter. JDS, on the other hand, is far more concentrated within the communications field than it is manufacturing.

The reason this is important is that during an economic downturn, companies like these two will be incentivized to look elsewhere for revenue -- especially because manufacturing would be so weak. That means that although IPG will surely lose business, it will gain market share. This increased market share sets the table for the company once the global economy recovers again.

Profit from manufacturing

Of course, you have to believe that if the global economy tanks, it will recover within the next 10 years. I believe it will, so I have no problem backing IPG in my All-Star CAPS portfolio or in my real-life account.

If, however, you aren't so sure about IPG's prospects, there are other ways to profit from manufacturing. Our special free report, "The Future Is Made in America,"details one such strategy. To find out about the three companies transforming manufacturing, get your copy of the report today, absolutely free!

At the time thisarticle was published Fool contributorBrian Stoffelowns shares of IPG Photonics. You can follow him on Twitter, where he goes byTMFStoffel.The Motley Fool owns shares of IPG Photonics and Rofin-Sinar Technologies.Motley Fool newsletter serviceshave recommended buying shares of IPG Photonics and Rofin-Sinar Technologies, and writing naked calls on JDS Uniphase. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.