How Low Can Pitney Bowes Go?

Shares of Pitney Bowes (NYS: PBI) recently hit a 52-week low. Let's take a look at how it got there and whether cloudy skies remain in the forecast.

How it got here

If I told you that the livelihood of Pitney Bowes' business depended on the mail, you'd probably shudder in horror. That explains in a nutshell why Pitney Bowes stock is ailing.

Pitney Bowes, a provider of mail processing equipment and mail solutions, has been hurt by the major push away from mail and toward electronic and digital communication. The company, whose postage machines were once staples in every business in the 1990s, is now struggling to find new avenues to grow. As the Fool's Dan Caplinger pointed out, Pitney Bowes did strike deals with both major express carriers, FedEx (NYS: FDX) and United Parcel Service (NYS: UPS) , but that has done little to help its falling revenue despite strong results from the two services. It also announced a geocoding deal with Facebook in yesterday's quarterly report, so perhaps that'll change its recent fortunes.

The other problem facing Pitney Bowes is that it missed its chance on securing decent market share in the digital era. Stamps.com (NAS: STMP) , Newell Rubbermaid (NYS: NWL) unit Endicia.com, and Pitney Bowes are the only three PC-approved online postage providers, yet Pitney Bowes has been unable to take a dominant position over the other two providers.

With the U.S. mail count shrinking and Pitney Bowes' debt load rising, many are left wondering where its future growth will come from.

How it stacks up

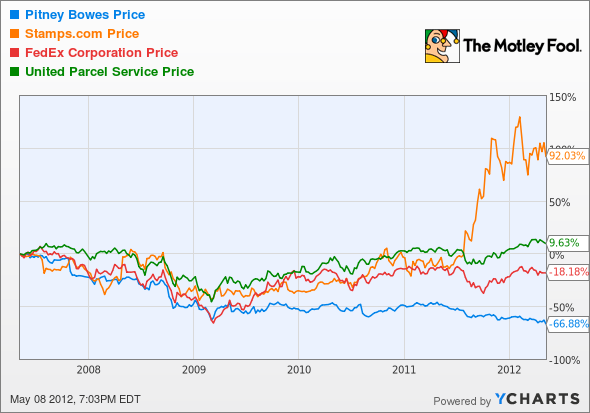

Let's see how Pitney Bowes stacks up next to its peers.

As you can see, the more digital the mail service provider, the stronger the results. Pitney Bowes and its stubborn resistance to identify this trend have left it deeply underperforming its peers.

Company | Price/Book | Price/Cash Flow | Forward P/E | 5-Year Revenue CAGR |

|---|---|---|---|---|

Pitney Bowes | NM | 3.5 | 7.8 | (1.6%) |

Stamps.com | 4.7 | 26.8 | 15.2 | 3.7% |

FedEx | 1.7 | 6.1 | 11.9 | 4.0% |

United Parcel Service | 10.6 | 10.9 | 14 | 2.3% |

Sources: Morningstar and author's calculations. NM = not meaningful, CAGR = compound annual growth rate.

Let's face it: We aren't dealing with explosive growth rates when we're examining the mail service sector. FedEx looks like the best overall bargain at just six times cash flow and a 4% annual growth rate over the past five years. Don't get me wrong, I wouldn't turn down UPS either, but FedEx is clearly the less expensive option of the two. Stamps.com has been showing up Pitney Bowes in the earnings column of late, but even it hasn't seen strong sales, with nearly all of its 3.7% five-year revenue gains coming in 2011. At 27 times cash flow, Stamps.com is anything but a bargain. But the worst of the bunch still appears to be Pitney Bowes, which is mired under $4.2 billion in debt -- enough to wipe out all shareholder equity and then some, and make the longevity of its dividend yield, which is now north of 9%, come into question.

What's next

Now for the real question: What's next for Pitney Bowes? The answer is really going to depend on whether or not it can find new avenues for growth and whether it can continue to pay out such a large dividend despite a hefty debt load.

Our very own CAPS community gives the company a three-star rating (out of five), with 83.7% of members expecting it to outperform. In true contrarian fashion, I've made a CAPScall of underperform on Pitney Bowes and that call is currently up 26 points as of this writing. I'm also not planning on closing that pick anytime soon.

Pitney Bowes may be striking up deals left and right with FedEx, UPS, and Facebook, but it's not generating any additional revenue from those deals. The company has bled revenue for three straight years as it continues to be left in the dust by its peers. Even worse, I feel its debt levels are growing unmanageable in terms of its extremely robust dividend payment. I might change my tune on Pitney Bowes as a pure dividend-income play if it reduced its debt, but until that happens, I will continue to hold a call of underperform on the stock.

If you'd like the inside scoop on three American companies that are looking like they'll outperform internationally, then look no further than these three picks by our analysts. Get your report for free by simply clicking here.

Craving more input on Pitney Bowes? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributorSean Williamshas no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen nameTMFUltraLong, track every pick he makes under the screen nameTrackUltraLong, and check him out on Twitter, where he goes by the handle@TMFUltraLong.Motley Fool newsletter serviceshave recommended buying shares of FedEx. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.