Forget 1 Trillion: Can Apple Become a Multitrillion-Dollar Company?

There's no shortage of predictions that Apple (NAS: AAPL) will one day become the world's first trillion-dollar company. Fellow Fool Tim Beyers thinks it can happen, while I'm already on record (on multiple occasions) saying I think it may become a reality soon enough.

That's a lot of zeroes

Well, here's a new one. One Street analyst now even thinks Apple could become a multitrillion-dollar company. A mere month ago, Topeka Capital Markets analyst Brian White, formerly of Ticonderoga Securities, went uber-bullish on the Mac maker by assigning it a $1,001 price target (no more, no less), which translated into a market cap of about $930 billion at the time.

This was before Apple's most recent blowout quarter, mind you, but well above the $666 price target that he had given Cupertino while at his previous employer. In the wake of its most recent earnings report, White is now boosting his price target to $1,111 (no more, no less), citing strong performance and the possibility of a growing dividend as catalysts.

Notably, that target also translates into a market cap of $1.03 trillion and represents more than 90% upside from current levels. He expects momentum to accelerate over the next year, driven by the sixth-generation iPhone (which some still call the iPhone 5 for some odd reason), an Apple TV set, an iPad Mini, and a potential partnership with China Mobile (NYS: CHL) .

He even goes as far as to call Apple's valuation "absurd relative to the company's growth" and notes that one of the things holding Apple back is "market cap phobia," which ties into the widely cited law of large numbers that make it seem impossible that Apple can keep on keepin' on. The concerns are justifiable, since it is rather ridiculous to imagine that Apple could reach revenue in the hundreds of billions.

White continues that once Apple crosses the trillion-dollar threshold, investors will shake off concerns over "market cap phobia" and begin to fully appreciate Apple's earnings potential, saying, "We would not be surprised if Apple goes on to become a multitrillion-dollar company."

A numbers game

That's so large that it's hard to even fathom, but let's entertain this idea for a moment.

Right now, Apple has trailing-12-month sales of $142.4 billion. Analysts are expecting fiscal 2013 to see sales of $195.5 billion -- and how often does Apple smash their estimates? At the growth rates that Apple keeps putting up, it seems that in a matter of years it could catch up to Wal-Mart's (NYS: WMT) top line, which currently has $447 billion in TTM sales. Of course, the big difference is that Wal-Mart's net margin is 3.7%, while Apple's is 27.1%.

The notion of seeing Apple dethrone Wal-Mart from the No. 1 spot in the Fortune 500 is downright absurd, but then again, even Apple CEO Tim Cook's mind is already boggled, by his own admission. Speaking about China on the last conference call, he said, "So it is mind-boggling that we can do this well." Even Cook is amazed, and he's privy to all sorts of information we mere mortals can't see.

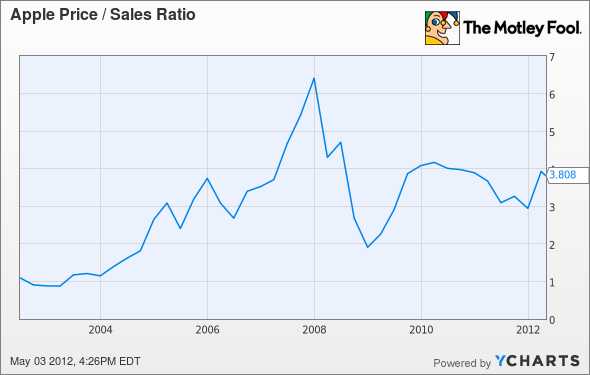

White's certainly not putting any type of time frame on such a possibility, and it would take years to get there, if at all. If Apple was worth $2 trillion, we're talking about a per-share price of about $2,150, assuming no splits. Apple's price-to-sales ratio has fluctuated over the years but has averaged 3.65 over the past 10 years.

AAPL Price / Sales Ratio data by YCharts

Using that average and a $2 trillion valuation, that implies revenue of nearly $550 billion. The iPhone now comprises 58% of revenue and has been steadily rising. If we say half of revenue comes from the iPhone, that's $225 billion. At the lifetime average selling price of about $640, we're talking about 350 million iPhone unit sales annually. That's more than one iPhone for every man, woman, and child in the United States today.

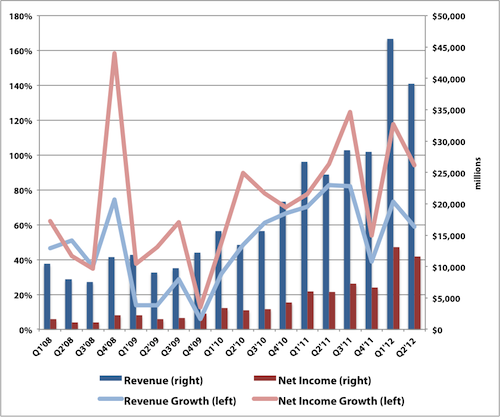

Sounds impossible, right? Well, remember that Apple is already up to 109.5 million iPhone unit sales over the past four quarters, and the device has averaged 155% year-over-year unit sales growth per quarter since inception, with the median being 107% growth. Nearly three-quarters of iPhones are now sold internationally, and some emerging markets -- notably China -- are now seeing 400% unit sales growth.

We haven't even started talking about the nascent iPad market. The iPad has had only four quarters to measure year-over-year growth stats (out of eight total quarters it's been on sale), but it's similarly averaged 153% growth with a median of 158%.

Doesn't sound so far-fetched anymore, does it?

Won't say it ain't so

When talking about numbers that large, traditional valuation models are at a loss for words, since that would be uncharted territory for any company. What kind of price-to-sales ratio should a $2 trillion company have? What do you even compare it with?

I'm not ready to say that I think Apple will become a multitrillion-dollar company, but I'm also not going to say that it won't.

We've been talking a lot about trillions, so The Next Trillion-Dollar Revolution seems relevant. Might as well grab a copy of this special report. It's free.

At the time thisarticle was published Fool contributorEvan Niuowns shares of Apple, but he holds no other position in any company mentioned. Check out hisholdings and a short bio. The Fool owns shares of Apple.Motley Fool newsletter serviceshave recommended buying shares of China Mobile and Apple and creating a bull call spread position in Apple.Motley Fool newsletter serviceshave recommended creating a diagonal call position in Wal-Mart Stores. The Motley Fool has adisclosure policy. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.