Analyst Debate: Is Carnival a Top Stock?

The Motley Fool has been making successful stock picks for many years, but we don't always agree on what a great stock looks like. That's what makes us "Motley," and it's one of our core values. We can disagree respectfully, and we often do. Investors do better when they share their knowledge.

In that spirit, we three Fools have banded together to find the market's best stocks, which we'll rate on The Motley Fool's CAPS system as outperformers or underperformers. We'll be accountable for every pick based on the sum of our knowledge and the balance of our decisions. Today we'll be discussing Carnival Cruise Lines (NYS: CCL) , one of the two major global cruise lines and a leader in leisure travel.

Carnival by the numbers

Carnival has been growing quickly over the past decade. Here's a snapshot of the company's most important numbers:

Statistic | Result (most recent available) |

|---|---|

Revenue | $15.96 billion |

Net Income | $1.62 billion |

Profit Margin | 10.2% |

Market Capitalization | $26.1 billion |

Total Debt (short term / long term) | $1.56 billion / $7.96 billion |

Capital Expenditures | $2.79 billion |

Dividend Yield | 3.1% |

Total Ships / Passenger Capacity | 99 / 195,872 |

Planned New Ships / Capacity | 10 / 32,000 |

Key Competitors |

Sources: Morningstar; Carnival 2011 annual report.

Alex's take

While not ironic (don't you just hate when that word gets misused?), it was certainly ominous that two major cruising disasters happened to Carnival subsidiary Costa Crociere on the centennial of the Titanic's sinking. The Costa Concordia incident, which claimed at least 32 lives when the ship ran aground in shallow water off the Italian coastline, is likely to result in costly lawsuits from survivors -- especially after the cruise line offered what can only be termed a $14,600 slap in the face. An engine fire on another ship only added insult to injury. Even if the financial damage is limited, as Costa is already trying to hide behind "international conventions," broader industry trends could be damaging for some time.

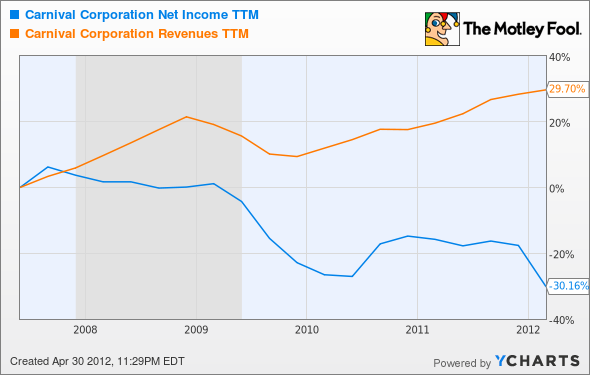

A slowdown or outright reversal of a years-long passenger growth trend could be dangerous for Carnival's bottom line, which was already in decline over the past five years, despite growing revenue.

CCL Net Income TTM data by YCharts.

It's little surprise that the company has failed to recapture pre-recession highs, as its key metrics look worse than they did before the crash. Free cash flow, again erratic over the five-year period, is up just more than 4% from 2007, although Carnival spent a lot of time in 2009 and 2010 cash-flow negative. Royal Caribbean, on the other hand, grew revenue at a faster rate and barely managed to eke out positive profit growth after an atrocious 2010.

The business is getting costly, and cruise lines seem hard-pressed to maintain positive earnings momentum. Perceived danger (regardless of how unlikely another disaster is) and shrinking margins aren't enough to make this a good opportunity today, despite its dividend and cruise-related perks for stockholders. I'll keep my flag planted on dry land.

Sean's take

I've often told people that you can forecast industry trends and growth patterns until the day you die, but you can never factor in stupidity -- and stupidity is what's going to keep Carnival's stock floating steadily down river.

Since the tragic disaster of the Costa Concordia in January and the subsequent fire on the Allegra, the key factor hasn't been what Carnival was going to do to get customers back on its cruise ships, but what could be done to improve the image of Carnival CEO Micky Arison.

My primary beef with Mr. Arison was his delayed response (more than one week, according to The Wall Street Journal) to the Costa Concordia tragedy and his lack of response just six weeks later regarding the fire on the Costa Allegra. He seemed concerned more with the Miami Heat, which he owns, than Carnival Cruise Lines, leaving shareholders as an afterthought.

Carnival's accident affected the entire sector, with Royal Caribbean reporting a sales slowdown and Disney noting that its February bookings were down. However, it should be noted that Disney's bookings were nearly full prior to the incident, and Royal Caribbean's sales have rebounded significantly over the past few weeks, leading me to believe that this is more of a PR nightmare for Carnival than a sectorwide weakness.

Following a heavy reduction in projected 2012 EPS to a range of $1.40 to $1.70 from $2.55 to $2.85, it's going to take some serious schmoozing from Mr. Arison to win me back over to the optimists' camp. As of now, I see troubled seas ahead for Carnival.

Travis' take

The downside of Carnival is obvious right now. The two accidents Alex and Sean talked about hang not only a black mark on the company, but also add a potentially large liability to the balance sheet. But I don't think it will hurt the industry as a whole in the long term, and customers and investors will soon forget these follies.

As pointed out above, Royal Caribbean's stock has barely blinked an eye, and as fellow Fool Rick Munarriz points out, Steiner Leisure (NAS: STNR) has barely moved, even though it has exposure to the industry with its presence aboard 125 ships. So the prevailing thought is that the industry won't be heavily affected, and the one comparison company I could think of has recovered as well.

The one disaster that captured attention like the Costa Concordia in recent memory was the BP (NYS: BP) oil spill. The stock plunged, there were boycotts, and it seemed like the world would end for BP. Even the executive incompetence mirrors Carnival. But BP's stock has rebounded despite the massive costs of the oil spill. I'm afraid shorting Carnival now would be like shorting BP at the bottom, which would have ended in a losing bet.

The question we have to ask is whether these disasters are likely to happen again. Unlike the oil industry, where spills happen rather often and major disasters can be expected about once a decade, the sinking of a cruise ship is an extremely rare event. The idiocy that led up to the Costa Concordia disaster can't be overlooked, but I can't find evidence that such recklessness is commonplace. So, as with BP, eventually consumers will forget about the disaster and come back. For that reason, I have a hard time betting against the stock right now.

With all of that said, I still don't want to own it, either, for the reasons Alex and Sean pointed out.

The final call

There you have it -- a rare agreement. Travis' points about selling at the bottom are valid, but there are also compelling financial reasons to expect Carnival to be a long-term underperformer. We'll be giving Carnival an underperform CAPScall in The Motley Fool's CAPS, which you can follow on our TMFYoungGuns CAPS page. Whether you agree or disagree, we welcome your comments!

Carnival may not rule the waves any longer, but there are still plenty of opportunities to invest in companies dominating on dry land. Find out about the "3 American Companies Set to Dominate the World" in The Motley Fool's newest free report. Just click here for all the information you need on these great companies, at no cost.

At the time thisarticle was published Fool contributor Travis Hoium owns shares of Disney, but holds no other financial position in any companies mentioned here. Fool contributors Alex Planes and Sean Williams hold no financial position in any company mentioned here. You can follow Alex on Twitter at @TMFBiggles, Travis at @FlushDrawFool, and Sean at @TMFUltraLong.The Motley Fool owns shares of Disney. Motley Fool newsletter services have recommended buying shares of Disney. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.