Can JDSU Break These Terrible Trends?

Three months ago, JDS Uniphase (NAS: JDSU) crushed Wall Street's earnings estimates with a 50% surprise. The stock jumped at first but has since fallen back to where it was before that fine report.

The maker of telecom-grade networking equipment reports third-quarter results after Wednesday's closing bell. What should we expect this time?

Analysts take a dim view of the third quarter. In a year-over-year comparison, earnings are expected to drop by half to $0.11 per share on 7.4% lower sales. The company has been hit-and-miss on the bottom line lately, as two of the last four reports came with upside surprises but the other two missed the Street's targets.

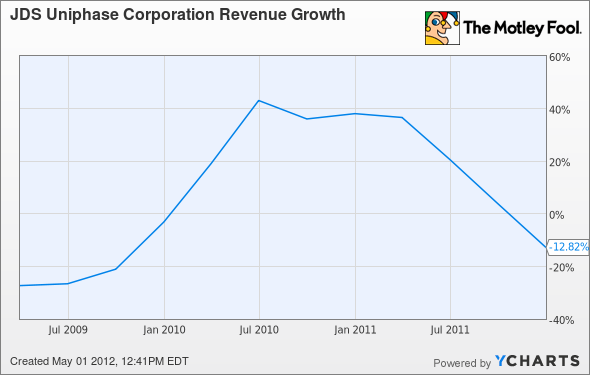

The last two quarters have also showed a troubling revenue trend. JDSU delivered strong and predictable revenue growth throughout most of 2011 but the boom times could be ending.

JDSU Revenue Growth data by YCharts.

JDSU used to have much of its hardware manufactured by outsourcing specialist Fabrinet (NYS: FN) , but that changed dramatically when flooding in Thailand wiped out several Fabrinet factories. Now none of JDSU's orders go through Fabrinet.

Instead, JDSU depends on a large network of contractors and is in the process of whittling the contracts down significantly. By playing the cast of characters against each other, JDSU hopes to settle long-term deals at reasonable prices. "That will give us some price leverage," says CFO David Vellequette. If that works out as expected, JDSU could boost gross and operating margins a fair bit here. That process should be done already, so look for a discussion of manufacturing contracts this week.

Rivals in the optical networking space have not done well in recent months. JDSU investors can count their lucky stars for a breakeven three-month performance as Finisar (NAS: FNSR) fell 17% and Oclaro (NAS: OCLR) dropped 35%. Finisar saw telecom customers spending less on network upgrades in its early March report. Oclaro is merging with smaller rival Opnext (NAS: OPXT) in a bid to ride out this storm.

In the long run, there's no doubt that high-speed networking will reward investors. Mobile networking sits on top of the big data boom, and that combination of trends requires massive growth in core network speeds for years to come. But you have to sift the winners from the wannabes, and JDSU has the scale to prevail. That's why I have a mildly profitable thumbs-up CAPScall on the stock right now, even as other Fools have very bearish views on it. It would take a pretty epic disaster of a quarter to make me change my mind on Wednesday.

At the time thisarticle was published Fool contributor Anders Bylund holds no position in any of the companies mentioned. Check out Anders' holdings and bio, or follow him on Twitter and Google+. Motley Fool newsletter services have recommended writing naked calls on JDS Uniphase. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinion, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.