How the Wheels Came Off NeuStar's Bus

NeuStar (NYS: NSR) reported earnings on April 26. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended March 31 (Q1), NeuStar met expectations on revenues and whiffed on earnings per share.

Compared with the prior-year quarter, revenue grew significantly and GAAP earnings per share contracted significantly.

Margins dropped across the board.

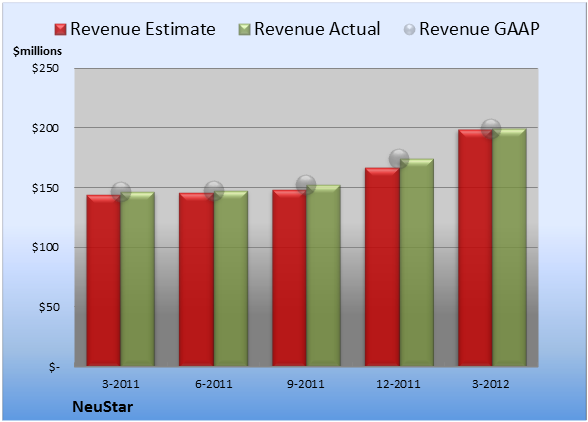

Revenue details

NeuStar logged revenue of $199.6 million. The 12 analysts polled by S&P Capital IQ wanted to see a top line of $199.1 million on the same basis. GAAP reported sales were 36% higher than the prior-year quarter's $146.5 million.

Source: S&P Capital IQ. Quarterly periods. Dollar amounts in millions. Non-GAAP figures may vary to maintain comparability with estimates.

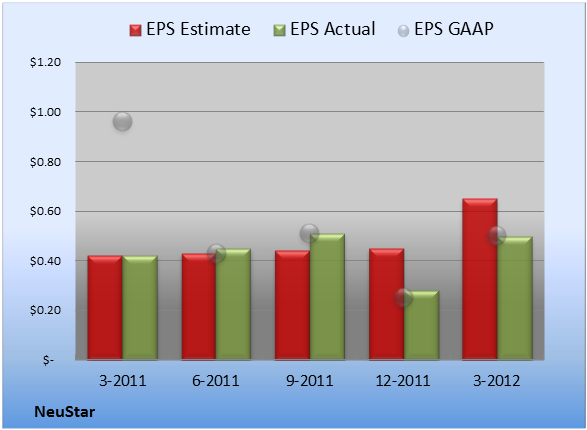

EPS details

EPS came in at $0.50. The 10 earnings estimates compiled by S&P Capital IQ anticipated $0.65 per share. GAAP EPS of $0.50 for Q1 were 48% lower than the prior-year quarter's $0.96 per share.

Source: S&P Capital IQ. Quarterly periods. Non-GAAP figures may vary to maintain comparability with estimates.

Margin details

For the quarter, gross margin was 77.5%, 90 basis points worse than the prior-year quarter. Operating margin was 32.5%, 440 basis points worse than the prior-year quarter. Net margin was 17.0%, 3,210 basis points worse than the prior-year quarter.

Looking ahead

Next quarter's average estimate for revenue is $203.1 million. On the bottom line, the average EPS estimate is $0.68.

Next year's average estimate for revenue is $820.9 million. The average EPS estimate is $2.74.

Investor sentiment

The stock has a four-star rating (out of five) at Motley Fool CAPS, with 259 members out of 271 rating the stock outperform, and 12 members rating it underperform. Among 83 CAPS All-Star picks (recommendations by the highest-ranked CAPS members), 79 give NeuStar a green thumbs-up, and four give it a red thumbs-down.

Of Wall Street recommendations tracked by S&P Capital IQ, the average opinion on NeuStar is outperform, with an average price target of $42.40.

Over the decades, small-cap stocks like NeuStar have provided market-beating returns, provided they're value-priced and have solid businesses. Read about a pair of companies with a lock on their markets in "Too Small to Fail: Two Small Caps the Government Won't Let Go Broke." Get instant access to this free report.

Add NeuStar to My Watchlist.

At the time thisarticle was published

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.