How High Can Dunkin' Brands Fly?

Shares of Dunkin' Brands (NAS: DNKN) hit a 52-week high yesterday. Let's take a look at how the company got there and whether clear skies are in the forecast.

How it got here

Who said there's no glory in riding Starbucks' (NAS: SBUX) coattails? Dunkin' Brands, the No. 2 coffee chain in the U.S., showed in its quarterly report yesterday just why it deserves to be trading at a new 52-week high.

For the quarter, Dunkin' reported a 7.2% increase in same-store sales for its Dunkin' Donuts locations in the U.S. and an even more robust 9.4% expansion for its Baskin-Robbins franchise in the United States. If there was one downside, it was that international expansion is underperforming domestic growth, which is very counterintuitive to Dunkin's growth strategy.

Another aspect that makes Dunkin' a strong performer is the partnerships the company has built with household names. Other than signing one of the most popular athletes in LeBron James to be its brand ambassador in Southeast Asia, Dunkin' also announced a partnership with Coca-Cola (NYS: KO) to sell Coca-Cola products at Dunkin' Brands restaurants in the U.S.

How it stacks up

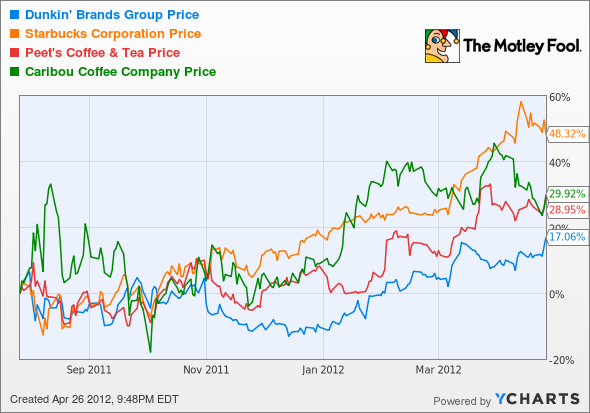

Let's take a look at how Dunkin' Brands stacks up next to its peers.

As coffee prices rose in the past, these companies have had little issue passing along price increases to consumers.

Company | Price/Book | Price/Cash Flow | Forward P/E | 5-Year Projected Growth Rate (per annum) |

|---|---|---|---|---|

Dunkin Brands | 5.3 | 21.6 | 22.7 | 14.5% |

Starbucks | 9.1 | 33.2 | 24.8 | 19.1% |

Peet's Coffee & Tea (NAS: PEET) | 5.5 | 80.6 | 32.9 | 23.0% |

Caribou Coffee (NAS: CBOU) | 3.4 | 12.0 | 23.2 | 24.3% |

Source: Morningstar, Yahoo! Finance.

If you're a value investor, turn away now lest you turn to stone! Without a doubt, coffee stocks are valued aggressively relative to cash flow and forward earnings. On an overall basis, at nearly 81 times cash flow, Peet's Coffee appears to be the priciest, while the considerably smaller Caribou Coffee looks like the closest stock to a "value play" in this sector at just 12 times cash flow. But neither of these two companies intrigues me enough from a valuation perspective to stray away from Starbucks, which is aggressively expanding into China, or Dunkin' Brands, which is growing same-store sales in high single-digits.

What's next

Now for the real question? What's next for Dunkin' Brands? That question really depends on whether Dunkin' can execute on its international expansion plans and if it can manage to keep Peet's Coffee and smaller player Caribou in the rearview mirror.

Our very own CAPS community gives the company a dreaded one-star rating (out of five), with 97 of 214 members expecting it to underperform. Consider me a dissenter as I've made a CAPScall of outperform on Dunkin' Brands and am currently up just shy of 14 points on that call.

The reason I continue to be bullish on Dunkin' relates to its easily identifiable brand name and the relatively untapped international market -- as of right now the company's domestic growth is just icing on the cake. Although Dunkin' Brands is trading at a premium valuation, its brand name, aggressive advertising, and international expansion should be enough to propel it to solid growth over the next decade.

Craving more input on Dunkin' Brands? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool owns shares of Starbucks and Coca-Cola. Motley Fool newsletter services have recommended buying shares of Starbucks and Coca-Cola, as well as writing covered calls on Starbucks. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.