How Low Can Barrick Gold Go?

Shares of Barrick Gold (NYS: ABX) hit a 52-week low on Friday. Let's take a look at how the company got there and whether cloudy skies remain in the forecast.

How it got here

You would think with gold prices in excess of $1,600 per ounce that the world's largest gold producer would not be sitting at a 52-week low, but that logic just isn't settling in with investors. The way I see it, Barrick Gold is suffering from two primary concerns -- one macroeconomic and one sector-related.

From a global perspective, gold investors are betting big that the U.S. economy isn't rebounding as quickly as the Federal Reserve would like and that another round of quantitative easing might be on the way. Another round of QE would greatly increase the active money supply and should boost gold, which is often used as an inflation hedge, higher. With little talk of QE recently, spot gold and mining stocks have been inching lower.

On a company level, Barrick Gold is experiencing significant cost inflation. Although production was flat and profits were up, the total cost of production rose 14% in its most recent quarter and the company cautioned that mining costs were going to rise even further over the near term. This industrywide inflation is being felt across the sector as mining costs and mine building become more expensive. Kinross Gold (NYS: KGC) recently curtailed the build-out of its Tasiast Mine in Mauritania because of rising costs while Thompson Creek Metals (NYS: TC) CEO, Kevin Loughrey, in an exclusive interview with the Fool's Christopher Barker, warned of steadily rising mining costs affecting metal miners' bottom lines going forward.

How it stacks up

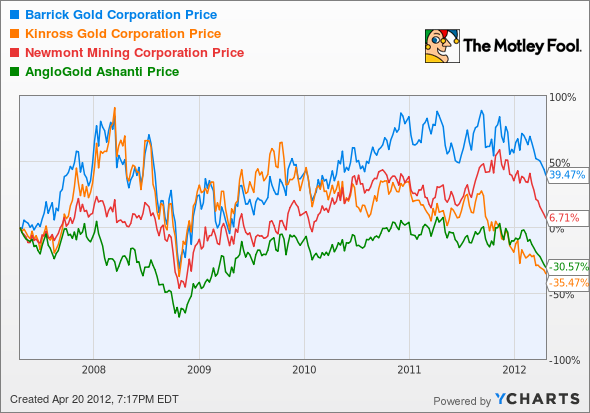

Let's see how Barrick Gold stacks up next to its peers:

As you can see from the chart above, miners of all sizes are being hit by rising labor and mine building costs.

Company | Price/Book | Price/Cash Flow | Forward P/E | 5-Year Revenue CAGR |

|---|---|---|---|---|

Barrick Gold | 1.7 | 7.3 | 6.4 | 20.4% |

Kinross Gold | 0.8 | 7.1 | 7.4 | 34.2% |

Newmont Mining (NYS: NEM) | 1.7 | 6.4 | 7.9 | 15.7% |

AngloGold Ashanti (NYS: AU) | 2.4 | 5.4 | 5.9 | 16.8% |

Source: Morningstar, author's calculations, CAGR = compound annual growth rate.

It's almost getting to the point where I'm ready to call the entire gold mining sector a buy. Even in cases where gold miners' production has remained relatively flat, increased reserves -- such as the nearly 140 million ounce boost at Barrick -- and higher spot gold prices are more than making up for rising costs. It would take, in my opinion, somewhere in the neighborhood of a 30%-40% drop in gold prices to really cause these valuations to be anywhere near reasonable. Despite the prediction of higher mining expenses from both Newmont Mining and AngloGold Ashanti, they both have their dividends tied to the price of gold and have been creating a nice bit of extra income for shareholders. Outside of Kinross, which is having its own mine-building dilemma, these mature mines look like amazing values.

What's next

Now for the real question: What's next for Barrick Gold? That question really depends on whether the company can get the rapid ascent of its costs under control and whether bullish sentiment returns to the gold market. Even at $1,600, gold companies literally are going to be rolling in profits, but Wall Street doesn't seem to see it that way.

Our very own CAPS community gives the company a three-star rating (out of five), with 94% of members expecting it to outperform. Although I have yet to make a CAPScall either way on Barrick Gold, I'm ready to change that now by starting it as an outperform in my CAPS account.

Barrick is one of the few miners that has the ability to deal with rapid cost inflation with ease. The company has a large workforce and it can streamline production, perhaps even cut production if needed, in order to reduce costs. Wall Street is looking at these miners as if rising costs are going to eat their profits alive when it would take practically a halving in the price of gold, if not more in some cases, for that to happen. Gold companies represent perhaps the ultimate value play in today's market and with many instituting dividends over the past year, they've become the income streams of the future. Barrick is too cheap for me not to add to my CAPS portfolio here.

Craving more input on Barrick Gold? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributor Sean Williams owns shares of Thompson Creek Metals, but has no material interest in any other companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.