How High Can Rackspace Hosting Fly?

Shares of Rackspace Hosting (NYS: RAX) hit a 52-week high recently. Let's look at how it got here and whether clear skies are ahead.

How it got here

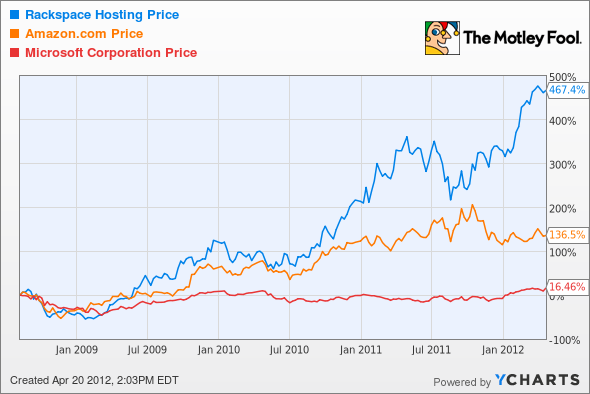

Rackspace is a quintessential cloud stock. The company's enterprise hosting services help serve up the Internet that we know today, while Rackspace competes against formidable heavyweights like Amazon.com (NAS: AMZN) and Microsoft (NAS: MSFT) .

A couple of months ago, Rackspace delivered an impressive quarter that boosted shares, and the momentum has continued ever since. Full-year revenue crossed the $1 billion threshold, net income jumped 65%, and the company sees more growth this year.

Its famous "Fanatical Support" mantra is just one reason Rackspace is a winner. (The curly slide helps too.) Its offerings go head-to-head with Amazon Web Services and Microsoft Azure, and its top-line growth shows it can tango with the best of them.

How it stacks up

Let's see how Rackspace stacks up with its peers, although they have more diversified businesses.

Let's throw in some more fundamental metrics to help add context to Rackspace's outperformance.

Company | P/E (TTM) | EPS Growth (MRQ) | Net Margin (TTM) | ROE (TTM) |

|---|---|---|---|---|

Rackspace | 103.6 | 79.5% | 7.5% | 14.7% |

Amazon | 139.2 | (57.8%) | 1.3% | 8.7% |

Microsoft | 11.3 | (2.2%) | 32% | 38.2% |

Source: Reuters. TTM = trailing 12 months. MRQ = most recent quarter.

There's no doubt that Rackspace carries a premium valuation, but it also has the earnings growth to help justify its lofty multiples. Amazon has been investing heavily in its infrastructure recently, which is holding back its bottom line. Azure also represents an important piece of Microsoft's cloud strategy.

What's next

There's good reason that Rackspace earned an official Rule Breakers recommendation years ago -- and has delivered market-thumping performance since then. It was a pioneer in enterprise hosting and has capitalized on that advantage.

Despite its hefty valuation, I think Rackspace is set to continue outperforming as the demand for hosting services continues marching skyward.

Interested in more info on Rackspace Hosting? Add it to your watchlist by clicking here.

At the time thisarticle was published Fool contributor Evan Niu owns shares of Amazon.com, but he holds no other position in any company mentioned. Click here to see his holdings and a short bio. The Motley Fool owns shares of Amazon.com and Microsoft. Motley Fool newsletter services have recommended buying shares of Rackspace Hosting, Microsoft, and Amazon.com. Motley Fool newsletter services have recommended creating a bull call spread position in Microsoft. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.