Regeneron Eyes a New 52-Week High: Can It Head Higher?

Shares of Regeneron Pharmaceuticals (NAS: REGN) hit a 52-week high yesterday. Let's look at how the company got here and ee whether clear skies remain in the forecast.

How it got here

Without question, the driving force behind Regeneron's rapid rise was the November approval of Eylea by the Food and Drug Administration to treat wet age-related macular degeneration. The drug is expected to generate $250 million to $300 million this year based on Regeneron's estimates, although it will face stiff competition from the current standardized AMD drug, Lucentis, which is co-marketed by Roche (OTC: RHHBY.PK) and Novartis (NYS: NVS) and Avastin (also owned by Roche), which is not formally approved to treat wet AMD but does indeed work for just a fraction of the cost of Eylea. Roche is in a tough spot, because if it seeks wet-AMD approval for Avastin, it may inadvertently cannibalize sales of Lucentis and give Eylea the edge.

For Regeneron, this is really a storybook tale of how to properly launch a drug. We've seen multiple instances of botched drug launches that have destroyed shareholder value. Both Dendreon's (NAS: DNDN) prostate cancer treatment, Provenge, and Human Genome Sciences (NAS: HGSI) lupus drug, Benlysta, serve as stark reminders that getting a drug approved is only half the battle, as both companies have been losing money hand-over-fist since launching their drug. Actually having an experienced marketing team and getting physicians to prescribe your medicine is the other half of that battle.

How it stacks up

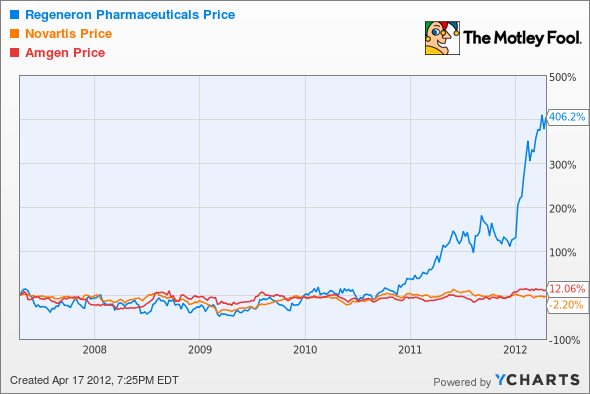

Let's see how Regeneron stacks up next to its peers.

Investors have been amply rewarded for Eylea's approval. Now let's look at this from a valuation perspective.

Company | Price/ Book | Price/ Cash Flow | Forward P/E | Dividend Yield |

|---|---|---|---|---|

Regeneron Pharmaceuticals | 24 | N/M | 76.9 | 0% |

Novartis | 2 | 9.4 | 9.9 | 4.5% |

Amgen | 2.8 | 12 | 10 | 2.2% |

Source: Morningstar. Dividend yields are projected.

Regeneron's five-year growth rate according to Yahoo! Finance estimates is a blistering 50%, but even that may not be fast enough to keep up with the company's astronomical valuation. While Wall Street waits for Regeneron to make consistent quarterly profits, Novartis and Amgen are kicking out healthy dividends and trading at forward P/Es of about 10. It's tough to value a recently approved drug from a fundamental perspective, but the proof that Regeneron may be overvalued is in the pudding.

What's next

Our very own Motley Fool CAPS community gives the company a dreaded one-star rating (out of five), with a full quarter of All-Star members expecting it to underperform. I am one of those members who have made a CAPScall of underperform on Regeneron and have thus far been humbled by a grotesque negative-108-point drubbing. I nonetheless remain steadfast in my prediction that Regeneron is grossly overvalued at these levels.

The company does has an impressive pipeline of drugs that could still affect its bottom line and perhaps bring its valuation more in line with reality, but the enthusiasm around Eylea's sales potential remains too great for me to advocate buying Regeneron here. If the picture clears up, then I might be willing to offer a more concrete forecast on Regeneron. But in the meantime, I stand by my underperform prognostication.

Craving more input on Regeneron Pharmaceuticals? Start by adding it to your free and personalized Watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributorSean Williamshas no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen nameTMFUltraLong, track every pick he makes under the screen nameTrackUltraLong, and check him out on Twitter, where he goes by the handle@TMFUltraLong.The Motley fool owns shares of Dendreon.Motley Fool newsletter serviceshave recommended buying shares of Novartis. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.