Is Annaly Capital a Buffett Stock?

As the world's third-richest person and most celebrated investor, Warren Buffett attracts a lot of attention. Thousands try to glean what they can from his thinking processes and track his investments.

We can't know for sure whether Buffett is about to buy Annaly Capital (NYS: NLY) -- he hasn't specifically mentioned anything about it to me -- but we can discover whether it's the sort of stock that might interest him. Answering that question could also reveal whether it's a stock that should interest us. In this series, we do just that.

Writing in a recent 10-K, Buffett lays out the qualities he looks for in an investment. In addition to adequate size, proven management, and a reasonable valuation, he demands:

Consistent earnings power.

Good returns on equity with limited or no debt.

Management in place.

Simple, non-techno-mumbo-jumbo businesses.

Does Annaly meet Buffett's standards?

1. Earnings power

Buffett is famous for betting on a sure thing. For that reason, he likes to see companies with demonstrated earnings stability.

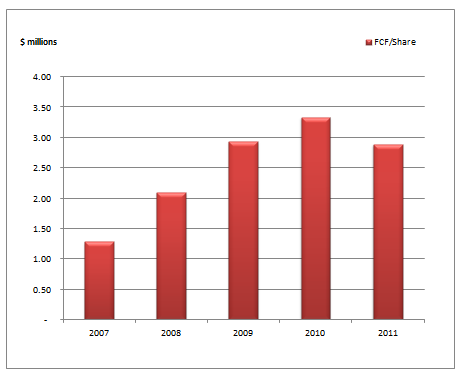

Let's examine Annaly's free cash flow per share history:

Source: S&P Capital IQ.

Free cash flow has risen dramatically over the past several years before falling back somewhat in 2011. Here's why:

Source: S&P Capital IQ.

Low interest rates have driven down Annaly's borrowing costs much faster than its interest yield. More recently, however, falling long-term rates at the zero short-term bound have begun to compress Annaly's interest rate profit spread. It's a similar story for practically every other residential mortgage REIT.

2. Return on equity and debt

Return on equity is a great metric for measuring both management's effectiveness and the strength of a company's competitive advantage or disadvantage -- a classic Buffett consideration. When considering return on equity, it's important to make sure a company doesn't have an enormous debt burden, because that will skew your calculations and make the company look much more efficient than it is.

Since competitive strength is a comparison between peers, and various industries have different levels of profitability and require different levels of debt, it helps to use an industry context.

Company | Debt-to-Equity Ratio | Return on Equity (LTM) | Return on Equity (5-year avg.) |

|---|---|---|---|

Annaly Capital | 557% | 3% | 11% |

American Capital Agency | 797% | 20% | 9% |

Chimera | 185% | 18% | 9% |

ARMOUR Residential | 871% | (3%) | 1% |

Source: S&P Capital IQ.

Annaly's return on equity plunged over the past year, largely thanks to accounting losses it reported on its massive interest rate hedges. Historically, however, the residential REIT pioneer has held its own against its younger peers.

Naturally, debt is a big part of the finance business. Even in boom times like today's, razor-thin profit margins are leveraged up to produce more decent returns on equity. That's particularly true of the pure agency-security REITs such as Annaly, American Capital Agency (NAS: AGNC) , and ARMOUR (NYS: ARR) , which generate narrower spreads thanks to their safer portfolios. American Capital and ARMOUR, however, tend to carry a fair bit more leverage than Annaly. Chimera (NYS: CIM) , which purchases more exotic (and riskier) securities, is able to produce a high return on equity without handling as much leverage.

Still, the mortgage REIT business has few barriers to entry or differentiating features, so it's not one that's prone to competitive advantages.

3. Management

Annaly's Chairman and CEO, Michael Farrell, has been at the job since he founded Annaly in 1997. He's widely regarded as a longtime expert as industry peers (including Annaly managed Chimera) grew up around Annaly, though my colleague John Maxfield recently took the company to task for its executive compensation policy.

4. Business

Annaly's business doesn't involve technological uncertainty, but it's important to remember that this is a cyclical business filled with a fair bit of interest rate and refinancing risk.

The Foolish conclusion

So is Annaly a Buffett stock? Probably not. The company exhibits some of the characteristics of a quintessential Buffett investment: tenured management and a business that doesn't rely too heavily on technology innovation. However, Buffett, who often reminds us that his favorite holding period is forever, might prefer to see a business with a stronger competitive advantage whose earnings are less beholden to cyclical factors. That being said, I do think Annaly and many other REITs' shareholders probably have at least another couple of years of large dividend payouts waiting for them.

If you're looking for some solid dividend stocks, I also suggest you check out "Secure Your Future With 9 Rock-Solid Dividend Stocks," a special report from the Motley Fool about some serious dividend dynamos. I invite you to grab a free copy to discover everything you need to know about these nine generous dividend payers -- simply click here.

At the time thisarticle was published Ilan Moscovitz doesn't own shares of any company mentioned. Try any of our Foolish newsletter services free for 30 days. The Motley Fool owns shares of Annaly Capital Management. Motley Fool newsletter services have recommended buying shares of Annaly Capital Management. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.