Why Intuitive Surgical Is Right for Your IRA

This article is part of our Right for Your IRA series, in which Foolish writers each pick a stock or ETF that could be a great fit in a tax-advantaged retirement account.

For this series, many of my Fool colleagues have picked slow and steady companies for your IRA. There's nothing wrong with that; they're all solid picks. But alongside them, I think most IRAs could use a little growth, especially for investors many years away from retirement who can afford to take the additional risk inherent with added growth potential.

And the growth potential in Intuitive Surgical (NAS: ISRG) looks pretty good.

Why Intuitive Surgical?

Intuitive Surgical sells da Vinci surgical machines, which help doctors perform robotic surgery with small incisions and more precise cuts. It's become the go-to surgery type for prostatectomies and the company has moved on to other types of surgeries including hysterectomies.

The company will have to continue pressing into other surgeries to continue growth -- revenue is up 36% annually over the last five years -- but the real magic of the business model is in the machines it's already placed. Each surgery performed uses instruments that the company sells. And hospitals have to pay Intuitive Surgical to maintain their systems. Last year, revenue from instruments, accessories, and services made up more than half of the revenue.

It's the business model perfected by Gillette when the company practically gave away its razor handles, counting on future sales of razor blades to make up for the cost. Hewlett-Packard (NYS: HPQ) also uses the model in its printers, making money on ink sales for years after a printer is sold. Except Intuitive Surgical isn't giving away the machines; they sell for $1.5 million apiece.

Why in your IRA?

Simply put, investing in Intuitive Surgical could make for difficult tax planning.

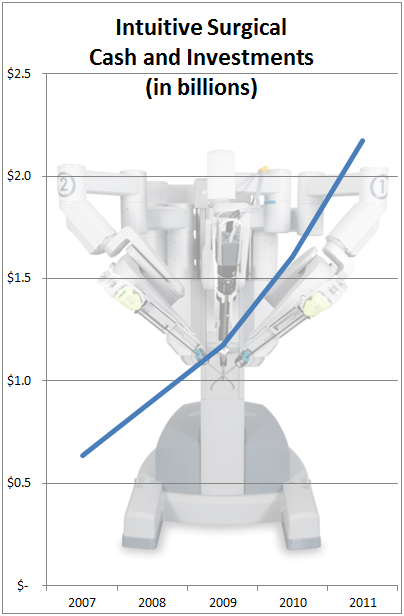

Intuitive Surgical is a cash-generating machine. The company threw off nearly $600 million in free cash flow last year and has been hording it like a leprechaun in March.

The company has used some of the cash it generates to repurchase $680 million in stock over the last three years, and has $568 million remaining on the current buyback program. Share repurchases don't affect shareholders' tax bills, but they're not necessarily the best use of shareholder cash either, since they're often done with little concern for the current share value.

Intuitive Surgical could follow in Apple's (NAS: AAPL) footsteps and start a quarterly dividend, but I don't think the company is likely to go that route, nor would it necessarily be the best move considering Intuitive Surgical is still in more of a hyper-growth mode than Apple is.

Investors wouldn't mind getting hold of some of that cash back in the form of a special dividend, however. When? How much? That would all be up to management, with investors just having to live with the tax burden it causes -- unless it's in an IRA, of course.

Management could also introduce a tax burden if it arranged for a sale of the company. I don't see Intuitive Surgical putting itself on the chopping block, but an unsolicited offer the company couldn't refuse isn't out of the question.

A few years ago we could have named a number of medical device companies that could purchase Intuitive Surgical, but as it's grown -- an enterprise value of $20 billion -- the larger conglomerates would seem like obvious suitors.

Intuitive Surgical would fit well into Johnson & Johnson's (NYS: JNJ) corporate structure, giving subsidiary companies the ability to act independently. Johnson & Johnson isn't known for overpaying, but it certainly could use the hyper-growth Intuitive Surgical could provide.

The large medical equipment sold by General Electric's (NYS: GE) health-care division would fit nicely with the da Vinci machines. The potential synergies could make it worth more to GE than individual investors are willing to pay.

In addition to the forced selling through a sale of the whole company, investors might need to sell Intuitive Surgical shares themselves. If someone invested 5% of his or her portfolio in Intuitive Surgical 10 years ago, it would have become more than half of the portfolio if the other 95% returned the S&P 500 average. Even for a company as solid as Intuitive Surgical, that's a lot of risk to be taking with one company. Trimming the position would seem prudent, especially for money set aside for retirement.

If the shares are in a taxable account, investors would pay capital gains tax on the shares, which might be lower than the tax they'd have to pay when the cash is removed from a traditional IRA. But if the shares are in an IRA, there's no immediate tax bill and investors get to hold on to all the gains, compounding them with whatever investment they move into.

Keep it light

Intuitive Surgical isn't without risk. It's had a great long-term run, but its growth is dependent on the capital expenditures of hospitals, which is usually tied to the economy. During the last recession, Intuitive Surgical lost two-thirds of its value in just a few months.

If you're going to buy Intuitive Surgical, I'd recommend keeping it a manageable portion of your portfolio. If you're looking for additional ideas to invest in alongside Intuitive Surgical, check out the Fool's new free report "3 Stocks That Will Help You Retire Rich." Get yours free by clicking here.

See what else our Foolish writers would add to an IRA; click back to the series intro for links to the entire series.

At the time thisarticle was published Fool contributor Brian Orelli holds no position in any company mentioned. Click here to see his holdings and a short bio. The Motley Fool owns shares of Apple. Motley Fool newsletter services have recommended buying shares of Intuitive Surgical, Apple, and Johnson & Johnson. Motley Fool newsletter services have recommended creating a diagonal call position in Johnson & Johnson and a bull call spread position in Apple. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.