Titan Machinery Hit a 52-Week High

Shares of Titan Machinery (NAS: TITN) hit a 52-week high yesterday. Let's look at how it got here and whether clear skies are ahead.

How it got here

Titan has been crushing earnings estimates for over a year and this week's earnings report drove shares to new heights. Earnings per share hit $0.84 as revenue jumped a whopping 65%. The market has finally come to the realization that this is a lasting procurement cycle in agriculture and construction and rewarded the stock.

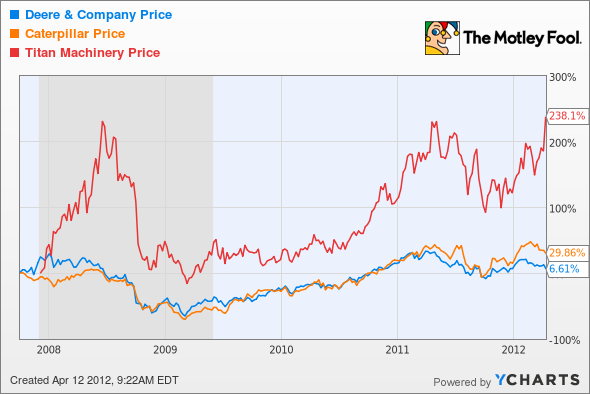

Titan has even outperformed the equipment makers themselves over one and five years.

Deere price chart data by Ycharts.

Versus these manufacturers Titan has the advantage of not having the capital invested in equipment used to make equipment, leveraging the company to manufacturers' results.

When you're hot, you're hot

When you find a hot stock, you often find one crushing expectations put up by the "experts." Titan is no different and beating earnings estimates has been the driver of the stock's recovery since the lows of recession.

Q1 2012 | Q2 2012 | Q3 2012 | Q4 2012 | |

|---|---|---|---|---|

Analyst Estimates | $0.22 | $0.26 | $0.50 | $0.53 |

Actual EPS | $0.40 | $0.30 | $0.61 | $0.84 |

Source: Yahoo! Finance

Analysts don't seem to be learning any lessons from this drubbing, raising fiscal 2013 estimates by only $0.07 over the last three months.

What's next?

There's no guarantee that earnings will continue to beat estimates, but I think the chances are high. The construction market is just starting to get on its feet, farmers are realizing the benefits of higher commodity prices, and the season ahead should be stronger for both of those markets. Combine that with the fact that analysts appear to be asleep at the wheel and I think this is just the beginning of new highs for Titan.

The CAPS community agrees with me, giving the company a five-star rating. What do you think? Leave your thoughts in the comments section below and click here to add Titan Machinery to your personalized My Watchlist.

At the time thisarticle was published Fool contributorTravis Hoiumdoes not have a position in any company mentioned. You can follow Travis on Twitter at@FlushDrawFool, check out hispersonal stock holdingsor follow his CAPS picks atTMFFlushDraw.Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.