Is There a Light at the End of Rite Aid's Tunnel?

Another earnings season is upon us, and it's a make-or-break time for most publicly held companies. If a company exceeds Wall Street's expectations for revenue and earnings, its stock price could be off to the races. On the other hand, any shortfall could spell disaster. Up Thursday, before the market closes: Rite Aid (NYS: RAD) .

Analysts expect the drugstore chain to report $7.03 billion in revenue and negative-$0.14 in EPS, which is a 71.4% improvement over last year's negative-$0.24 a share. If the company meets its revenue target, it'll mark an 8.9% increase from last year's $6.46 billion, but it has reported negative EPS for the past 11 quarters.

Let's see how those figures compare with some of Rite Aid's competitors, including Wal-Mart (NYS: WMT) , Costco (NAS: COST) , CVS Caremark (NYS: CVS) , and Walgreen (NYS: WAG) .

Company | Reporting Date | Revenue | EPS |

|---|---|---|---|

Wal-Mart | April 17 | $1.06 billion | $0.17 |

Costco | May 24 | $22.15 billion | $0.87 |

CVS Caremark | May 2 | $30.31 billion | $0.63 |

Walgreen | June 26 | $17.92 billion | $0.63 |

When looking at earnings quality, we at The Motley Fool have two databases -- EQ Scan and EQ Score -- that help us uncover cash flow and revenue recognition issues. Smart financial officers can use several techniques to manipulate financial results, and manipulation of any of the three financial statements usually affects the other two. But a critical eye on these statements can often uncover trends that could be important to help investors protect against losing their hard-earned money. The EQ Score database assigns an index rank to the company, from 1, for the lowest quality, to 5, for the highest. As the company's financial status changes over time, the database adjusts its rank and illuminates trends that will affect earnings quality going forward.

The EQ Score model doesn't rank Rite Aid because it isn't part of the S&P 1500 Composite Index. However, based on the preview of Rite Aid's earnings quality, the company would rank in the middle of the road among companies in the index.

Like many other retailers, Rite Aid operates a very low-margin business model. Over the past three years, revenue has averaged $6.351 billion, cost of goods sold averaged 74% of top-line revenue, and selling, general, and administrative costs have averaged 25%, leaving a whopping operating margin of 1%. EBITDA has averaged $188 million over the previous several quarters, and EBITDA margins have been stable at 3% over the same periods.

Days sales outstanding is a respectable 14 days, and accounts receivable as a percentage of revenue has declined over the past three years and now stands at 15%. Rite Aid's inventory as a percentage of revenue also has been stable at 54%, but days in inventory, while declining slightly, is at 67 days, suggesting that better inventory management could improve margins going forward.

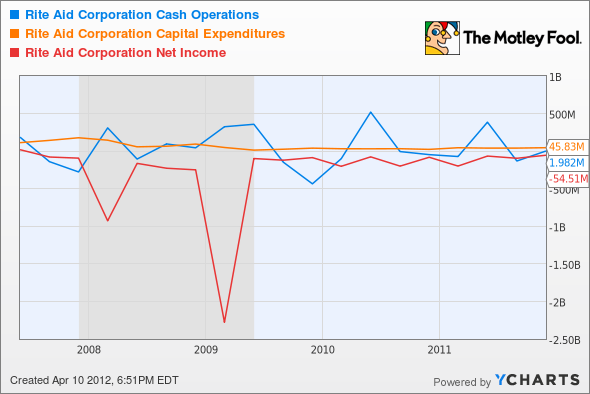

Rite Aid's major issue for some time has been net income:

RAD Cash Operations data by YCharts

The company barely survived the recession and since then has continued to report negative earnings. Cash from operations has been positive because of asset writedowns, restructuring costs, amortization and depreciation of goodwill, and other intangibles. However, capital expenditures and huge repayments of long-term debt have kept cash flows decidedly negative since 2009. Long-term debt and other long-term liabilities have grown from $9.526 billion to $9.963 billion, despite exhausting available cash to pay down the debt.

In the hierarchy of metrics that affect earnings quality, revenue is at the top of the chart, and cash flow is more important that net income. In other words, Wall Street tends to focus on the wrong metric as the basis for its recommendations to buy, hold, or sell a stock. Rite Aid is clearly a company facing issues, but if the company reports improved revenue this quarter and in the future, and it improves the management of its inventory and operating costs, margins will improve.

As always, prudent Fools should make investment decisions based on consideration of earnings quality. With that in mind, even though Rite Aid entered the darkness of the tunnel during the recession, there may be some light ahead.

At the time thisarticle was published John Del Vecchio is the co-advisor of Motley Fool Alpha and co-manager of the Active Bear ETF. You may follow him on Twitter, where he goes by @johnfdelvecchio. He owns no shares of the companies mentioned here. The Motley Fool owns shares of Costco Wholesale and Wal-Mart Stores.Motley Fool newsletter serviceshave recommended buying shares of Wal-Mart Stores and Costco Wholesale and creating a diagonal call position in Wal-Mart Stores. The Motley Fool has adisclosure policy. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.