Here's What Will Drive H.J. Heinz's Results

In today's world, most companies span several regions and sell across the world. As my Foolish colleague Morgan Housel notes, 10 years ago, less than a third of S&P 500 revenue growth came from abroad. Today, that area makes up half of the S&P 500's growth.

And that number is growing. The truth is, investors regularly underestimate how much demand comes from abroad. More importantly, for large, multinational corporations that have already established a presence in their home markets, much of their future growth comes from abroad.

With that in mind, today we're looking at H.J. Heinz (NYS: HNZ) . We'll examine not only where its sales and earnings come from, but how its sales abroad have changed over time.

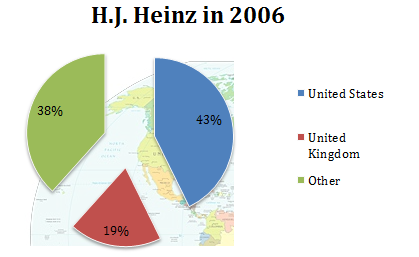

Where H.J. Heinz's sales were five years ago

Five fiscal years ago, H.J. Heinz produced 43% of its sales within the United States.

Source: S&P Capital IQ.

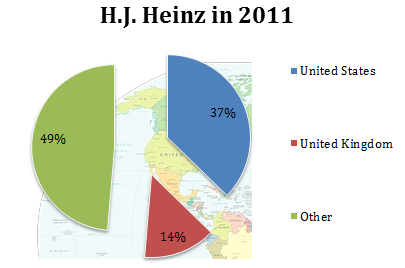

Where H.J. Heinz's sales are today

Today, while the United States is still a huge part of H.J. Heinz's story, its "Other" segment has swelled to 49% of sales from just 38% three years ago.

Source: S&P Capital IQ.

The United States reduced presence isn't because H.J. Heinz isn't seeing growth in the country, but rather because global sales have been so impressive outside the United Kingdom.

Segment | 5-Year Sales Growth |

|---|---|

United States | 8% |

United Kingdom | (8%) |

Other | 57% |

Comparing H.J. Heinz to some competitors, its rest-of-world sales look more impressive than Kellogg's (NYS: K) , a company which has seen largely stagnant international sales over the past three years. General Mills (NYS: GIS) has seen sales growth of only about 10% internationally over the past three years, but that total jumps to around 50% over the past five years.

This all highlights the global opportunity in front of food companies. As the middle class continues to grow across emerging markets, their addressable market only grows. If you're an investor in H.J. Heinz, the global opportunity will continue driving the growth of your stock across the next decade.

Keep searching for global opportunities

There's a reason companies are seeing outsized growth around the world; in the past decade, emerging market consumer spending grew 250%, leaving the growth rates of the U.S. and Europe in the dust. If you're an investor scanning the world for opportunities, look no further than our new report "3 Companies Set to Dominate the World." In the report, Fool analysts select three companies who have an international growth opportunity that's simply stunning. The report is free, but it won't be available forever, so get your copy by clicking here today!

At the time thisarticle was published Eric Bleeker owns shares of no companies listed above. Motley Fool newsletter services have recommended buying shares of H. Heinz. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.