Here's Where Abbott Laboratories Is Finding Its Growth

In today's world, most companies span several regions and sell across the world. As Foolish colleague Morgan Housel notes, 10 years ago, less than a third of S&P 500 revenue came from abroad. Today, that makes up more than half of the S&P 500's growth.

And that number is growing. The truth is, investors regularly underestimate how much demand comes from abroad. More importantly, for large, multinational corporations that have already established a presence in their home markets, much of their future growth comes from abroad.

With that in mind, today we're looking at Abbott Laboratories (NYS: ABT) . We'll examine not only where its sales and earnings come from, but how its sales abroad have changed over time.

Where Abbott's sales were three years ago

Three fiscal years ago, Abbott produced 47% of its sales within the United States.

Source: S&P Capital IQ.

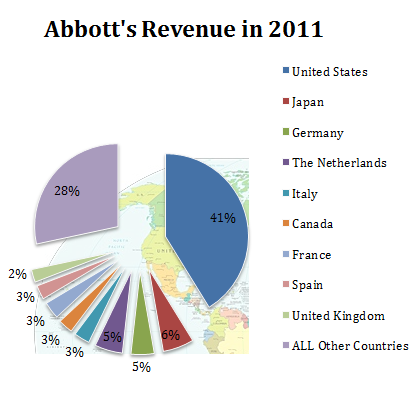

Where Abbott's sales are today

Today, America is still Abbott's largest market, but its influence is shrinking. While the United States still contributes 41% of sales, domestic sales growth lags far behind other regions.

Source: S&P Capital IQ.

Abbott is seeing extremely robust growth abroad, but it's not alone among its mega-cap pharmaceutical peers. Pfizer (NYS: PFE) used its Wyeth acquisition to boost its international profile. From 2003 to 2008, Wyeth saw international sales growth of 104% versus only 12% in the United States during the same time frame.

For the most part, the geographic profiles of most companies in the health-care sector are similar. If you're looking for a direct play into higher-growth markets, big pharma companies should benefit. But those companies may have a more difficult time than competitors in other industries such as consumer goods that compete on brand instead of intellectual property, which is easily copied in emerging markets that have limited controls on cheaper substitutes.

Keep searching for global opportunities

While pharma might struggle to capitalize on protecting its IP in many emerging markets, that shouldn't stop investors from looking for opportunities in these fast-growing markets. In the past decade, emerging market consumer spending grew 250%, leaving the growth rates of the U.S. and Europe in the dust. That's an opportunity you simply can't pass up, even if your preferred industry isn't seeing the most profitability. If you're an investor scanning the world for opportunities, look no further than our new report "3 Companies Set to Dominate the World." In the report, Fool analysts select three companies that have an international growth opportunity that's simply stunning. The report is free but won't be available forever, so get your copy by clicking here today!

At the time thisarticle was published Eric Bleeker owns no shares of companies listed above. The Motley Fool owns shares of Abbott Laboratories. Motley Fool newsletter services have recommended buying shares of Abbott Laboratories and Pfizer. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.