1 Scary Chart About China

The general impression of the Chinese economy is that it's overheated and bound to correct. Many investors have accordingly chosen to avoid it until it does so. Earlier this year, for example, my colleague Jeremy Bowman penned an article identifying three reasons he's avoiding China -- the first of which concerned the overexpansion of its real estate industry akin to the housing boom in the United States.

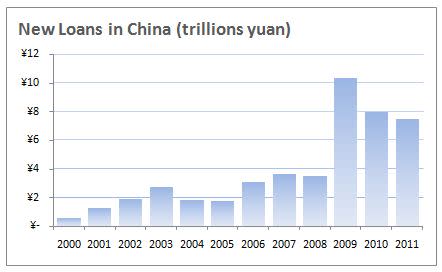

Although a uniform aversion to investing in China is probably unwarranted and unwise -- not to mention, it's basically impossible given the pervasive role of China in the global economy -- there are reasons for caution. One of which is illustrated in the following chart.

Source: People's Bank of China.

This is the annual amount of new loans in China as reported by the People's Bank of China, the country's central bank. What's immediately obvious is the jump in new loans from 3.5 trillion yuan in 2008 to 10.3 trillion yuan in 2009 -- an increase of nearly 300%.

This chart paints a scary picture to those of you familiar with the role of credit booms in financial crises. To those of you who aren't, the relationship is one of cause and effect. As we've seen many times before, most recently here in the United States, credit booms often lead to financial crises.

While the impact of a financial crisis in China would reverberate throughout the world, it would be felt most immediately by companies with direct exposure to the mainland. This includes Chinese companies like Baidu (NAS: BIDU) , the Chinese equivalent of Google, which is trading for 47 times earnings, and Renren (NYS: RENN) , the Chinese equivalent of Facebook, which is trading for 40 times earnings.

The impact would also likely be felt by American companies with direct exposure to the Chinese mainland. This includes fast food chains like Yum! Brands (NYS: YUM) , the purveyor of KFC and Pizza Hut, and McDonald's (NYS: MCD) . Yum added 656 restaurants to its Chinese operations in 2011 and plans to add 600 more this year. McDonald's plans to open a new outlet a day in China over the foreseeable future.

Foolish final thoughts

At the end of the day, it's too early to predict the implications of this credit boom. Will there be a hard landing, a soft landing, or no landing at all? No one knows for certain. You can, however, rest assured that the Chinese leadership is working fervently to avoid a financial calamity similar to the one we experienced in 2008 and 2009.

If you're on the hunt for a potential future multi-bagger, check our recently released free report "The Motley Fool's Top Stock for 2012." It reveals the identity of a little-known company that could be the next Costco of Latin America. To access this report while it's still available, click here now -- it's free.

At the time thisarticle was published Fool contributing writer John Maxfield does not have a financial stake in any of the companies mentioned above. Motley Fool newsletter services have recommended buying shares of Yum Brands, Baidu, and McDonald's. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.