Why Apple Is Poised for Another Blowout Quarter

Just two days ago I wrote about why Apple (NAS: AAPL) could see further gains this week and beyond. The basis for that call was that extremely strong iPad sales would drive earnings estimates up ahead of Apple's reporting its second quarter as analysts raced to update their iPad sales models.

Another catalyst?

However, while I believe Wall Street is underestimating the iPad's sales momentum, I've long crowed that Apple would post a blowout this quarter for another reason: China and the iPhone. As I said in a video posted two months ago:

"Apple has used growth in China in previous quarters to produce mind-boggling growth rates, but last quarter it managed to turn the tide on Android and execute in the Americas like never before. With rollouts to China and many other emerging markets just hitting next quarter, Apple's poised for a follow-up blowout."

Just like how Apple had disappointed in its fourth fiscal quarter of last year while investors held off buying iPhones waiting for the launch of the iPhone 4S, I believed that the limited availability of the iPhone in markets like Brazil in the holiday quarter and the complete absence of an iPhone 4S release in China during that quarter would create a boom for Apple when it reports its next earnings in late April.

That's because China has quietly become a driving force on Apple. Just look at this infographic I published last October to get a feel for Apple's China opportunity.

Then remember that in the quarter following that infographic -- Apple's fourth quarter -- Apple reported that a stunning 16% of its sales came from Greater China. Apple didn't report its breakdown of Chinese sales last quarter, in large part because sales were probably depressed as consumers waited for the iPhone 4S. Since the 4S went on sale this quarter at both China Unicom (NYS: CHU) and China Telecom (NYS: CHA) , Apple should see Chinese sales roar back when it next reports earnings.

More evidence of a blowout

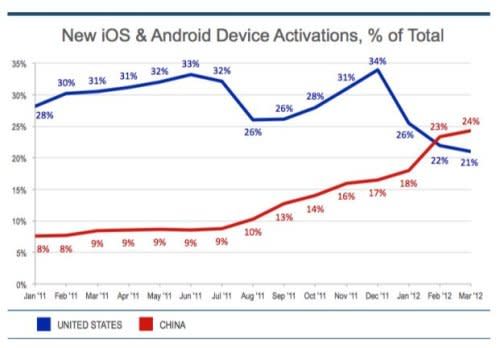

Today brought one more bit of news of China's emergence as the driving force in the smartphone world. Mobile-analytics firm Flurry published data that shows China now accounts for more iOS and Android device activations than the United States does.

Source: Flurry Analytics.

While this is hardly conclusive data about Apple's quarter, it's another data point that hints toward the success Apple and other smartphone makers are enjoying in China. That's great news for Apple investors because most of the news surrounding China mid-last month was about how the company was losing market share in the calendar fourth quarter. Apple had slipped into fifth place in the country that quarter, capturing 7.5% of the market, a figure well behind Samsung's leading 24.3% market share. However, again, it's worth noting that any narrative from the media about an Apple slip in China came at a time when Apple hadn't launched a new phone and consumers where waiting for the iPhone 4S launch. This is directly analogous to how the iPhone lost ground in America shortly before the iPhone 4S's release, only to have a record quarter once pent-up demand was satisfied with its release.

More ways to profit

Of course, exceeding expectations again isn't great news just for Apple. It means that its suppliers will exceed expectations in coming quarters as well. One great example of the "Apple effect" is Cirrus Logic (NAS: CRUS) , a company that has components in each major Apple product line. As an Apple investor, I know that there's more than one way to play China's underappreciated growth. I believe in Cirrus Logic so much that I've bought for in my personal portfolio and the real-money portfolio I manage on Fool.com. (Speaking of that portfolio, make sure to follow me on Twitter to get updates on my future tech buys. I have several great buy ideas planned for the week ahead.)

Finally, if you're looking for more iPhone plays like Cirrus Logic, we've created a new free report called "3 Hidden Winners of the iPhone, iPad, and Android Revolution," which not only details Cirrus Logic but also gives two other great ideas that are riding Apple's growth. To get your own copy of the report, just click here now -- it's free!

At the time thisarticle was published Eric Bleeker owns shares of Cirrus Logic. You can follow him on Twitter to see all of his technology and market commentary. The Motley Fool owns shares of Apple and Cirrus Logic. Motley Fool newsletter services have recommended buying shares of Apple and creating a bull call spread position in Apple. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.