What International Paper Does With Its Cash

In the quest to find great investments, most investors focus on earnings to gauge a company's financial strength. This is a good start, but earnings can be misleading and incomplete. To get a clearer understanding of a company's ability to earn money and reward you, the shareholder, it's often better to focus on cash flow. In this series, we tear apart a company's cash flow statement to see how much money is truly being earned and, more importantly, what management is doing with that cash.

Step on up, International Paper (NYS: IP) .

The first step in analyzing cash flow is to look at net income. International Paper's net income over the last five years has been impressive:

2011 | 2010 | 2009 | 2008 | 2007 | |

|---|---|---|---|---|---|

Normalized Net Income | $1.2 billion | $786 million | $539 million | $604 million | $889 million |

Source: S&P Capital IQ.

Next, we add back in a few noncash expenses, like the depreciation of assets, and adjust net income for changes in inventory, accounts receivable, and accounts payable -- changes in cash levels that reflect a company either paying its bills, or being paid by customers. This yields a figure called "cash from operating activities" -- the amount of cash a company generates from doing everyday business.

From there, we subtract capital expenditures, or the amount a company spends acquiring or fixing physical assets. This yields one version of a figure called "free cash flow," or the true amount of cash a company has left over for its investors after doing business:

2011 | 2010 | 2009 | 2008 | 2007 | |

|---|---|---|---|---|---|

Free Cash Flow | $1.5 billion | $0.9 billion | $4.1 billion | $1.7 billion | $0.6 billion |

Source: S&P Capital IQ.

Now we know how much cash International Paper is really pulling in each year. Next question: What is it doing with that cash?

There are two ways a company can use free cash flow to directly reward shareholders: dividends and share repurchases. Cash not returned to shareholders can be stashed in the bank, invested in other companies and assets, or used to pay off debt.

Here's how much International Paper has returned to shareholders in recent years:

2011 | 2010 | 2009 | 2008 | 2007 | |

|---|---|---|---|---|---|

Dividends | $427 million | $175 million | $140 million | $428 million | $436 million |

Share Repurchases | $30 million | $26 million | $10 million | $47 million | $1.2 billion |

Total Returned to Shareholders | $457 million | $201 million | $150 million | $475 million | $1.7 billion |

Source: S&P Capital IQ.

As you can see, the company has repurchased a decent amount of its own stock. But combined with other rounds of share issuance, shares outstanding have actually increased:

2011 | 2010 | 2009 | 2008 | 2007 | |

|---|---|---|---|---|---|

Shares Outstanding (millions) | 432 | 430 | 425 | 421 | 429 |

Source: S&P Capital IQ.

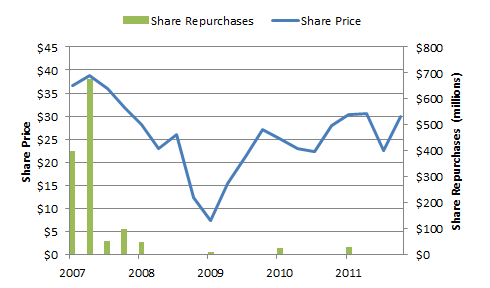

Now, companies tend to be fairly poor at repurchasing their own shares, buying feverishly when shares are expensive and backing away when they're cheap. Does International Paper fall into this trap? Let's take a look:

Source: S&P Capital IQ.

Not good. International Paper's only significant buybacks over the last five years came exactly as shares were at their peak. Once shares fell over 80%, the company had little interest in them. Whether this was a prudent way to save cash as it looked like the economy was about to implode, or a classic example of buying high and panicking low, is up for debate. In general, it doesn't appear management has been the most astute buyer of its own stock.

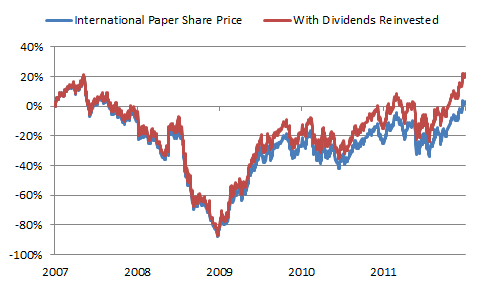

Finally, I like to look at how dividends have added to total shareholder returns:

Source: S&P Capital IQ.

Shares returned 26% over the last five years, which drops to 6% without dividends -- a nice boost to top off otherwise low performance.

To gauge how well a company is doing, keep an eye on the cash. How much a company earns is not as important as how much cash is actually coming in the door, and how much cash is coming in the door isn't as important as what management actually does with that cash. Remember, you, the shareholder, own the company. Are you happy with the way management has used International Paper's cash? Sound off in the comment section below.

Add International Paper to My Watchlist.

At the time thisarticle was published Fool contributor Morgan Housel doesn't own shares in any of the companies mentioned in this article. Follow him on Twitter @TMFHousel. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.