ANN INC Beats Up on Analysts Yet Again

ANN INC (NYS: ANN) reported earnings on March 9. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended Jan. 28 (Q4), ANN INC met expectations on revenues and beat expectations on earnings per share.

Compared to the prior-year quarter, revenue grew and GAAP earnings per share dropped significantly.

Margins dropped across the board.

Revenue details

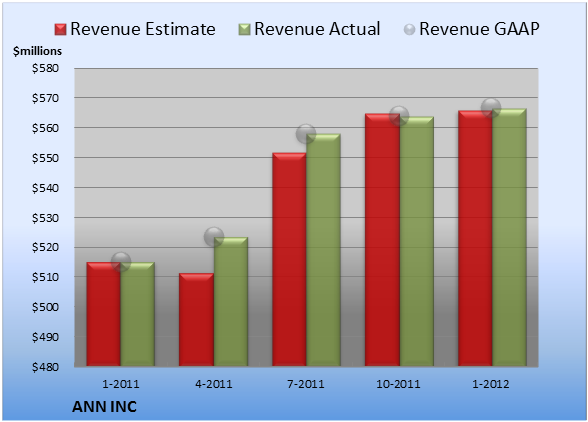

ANN INC recorded revenue of $566.7 million. The 11 analysts polled by S&P Capital IQ expected revenue of $566.0 million on the same basis. GAAP reported sales were 10.0% higher than the prior-year quarter's $515.3 million.

Source: S&P Capital IQ. Quarterly periods. Dollar amounts in millions. Non-GAAP figures may vary to maintain comparability with estimates.

EPS details

Non-GAAP EPS came in at $0.10. The 16 earnings estimates compiled by S&P Capital IQ predicted $0.08 per share on the same basis. GAAP EPS of $0.04 for Q4 were 71% lower than the prior-year quarter's $0.14 per share.

Source: S&P Capital IQ. Quarterly periods. Non-GAAP figures may vary to maintain comparability with estimates.

Margin details

For the quarter, gross margin was 48.9%, 280 basis points worse than the prior-year quarter. Operating margin was 1.5%, 130 basis points worse than the prior-year quarter. Net margin was 0.4%, 110 basis points worse than the prior-year quarter.

Looking ahead

Next quarter's average estimate for revenue is $560.1 million. On the bottom line, the average EPS estimate is $0.49.

Next year's average estimate for revenue is $2.39 billion. The average EPS estimate is $1.95.

Investor sentiment

The stock has a one-star rating (out of five) at Motley Fool CAPS, with 178 members rating the stock outperform and 86 members rating it underperform. Among 108 CAPS All-Star picks (recommendations by the highest-ranked CAPS members), 81 give ANN INC a green thumbs-up, and 27 give it a red thumbs-down.

Of Wall Street recommendations tracked by S&P Capital IQ, the average opinion on ANN INC is outperform, with an average price target of $30.71.

While many retailers continue to struggle in these tough economic times, a select few are changing the face of the business -- and reaping outsized rewards. Is ANN INC the right stock for you? Read "The Death of Wal-Mart: The Real Cash Kings Changing the Face of Retail" and decide. Click here for instant access to this free report.

Add ANN INC to My Watchlist.

At the time thisarticle was published

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.