Is Green Mountain Coffee Roasters a Buffett Stock?

As the world's third-richest person and most celebrated investor, Warren Buffett attracts a lot of attention. Thousands try to glean what they can from his thinking processes and track his investments.

We can't know for sure whether Buffett is about to buy Green Mountain Coffee Roasters (NAS: GMCR) -- he hasn't specifically mentioned anything about it to me -- but we can discover whether it's the sort of stock that might interest him. Answering that question could also reveal whether it's a stock that should interest us.

In his most recent 10-K, Buffett lays out the qualities he looks for in an investment. In addition to adequate size, proven management, and a reasonable valuation, he demands:

Consistent earnings power.

Good returns on equity with limited or no debt.

Management in place.

Simple, non-techno-mumbo-jumbo businesses.

Although the company might be too small for Buffett to literally invest in, let's see if Green Mountain might meet Buffett's standards.

1. Earnings power

Buffett is famous for betting on a sure thing. For that reason, he likes to see companies with demonstrated earnings stability.

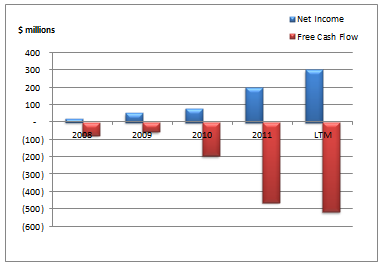

Let's examine Green Mountain's earnings and free cash flow history:

Source: S&P Capital IQ.

Green Mountain's earnings have grown dramatically over the past several years, while its free cash flow has tanked. While the free cash flow shortfall can be a sign of poor-quality earnings (and the SEC has investigated Green Mountain for possible accounting irregularities related to revenue recognition), part of the shortfall was due to heavy spending on inventory and capital investments that could just be seen as smart investments in future growth.

2. Return on equity and debt

Return on equity is a great metric for measuring both management's effectiveness and the strength of a company's competitive advantage or disadvantage -- a classic Buffett consideration. When considering return on equity, it's important to make sure a company doesn't have an enormous debt-to-equity ratio, because that will skew your calculations and make the company look much more efficient than it is.

Since competitive strength is a comparison between peers, and various industries have different levels of profitability and require different levels of debt, it helps to use an industry context.

Company | Debt-to-Equity Ratio | Return on Equity | 5-Year Average Return on Equity |

|---|---|---|---|

Green Mountain Coffee Roasters | 24% | 20% | 15% |

Starbucks (NAS: SBUX) | 12% | 29% | 23% |

Peet's Coffee & Tea | 0% | 10% | 9% |

SodaStream (NAS: SODA) | 0% | 22% | 14% |

Source: S&P Capital IQ.

Green Mountain is proving that when it comes to profitably selling coffee, there's more than one way to roast a bean. For years Starbucks' restaurant model was the envy of the industry. Although stores began to cannibalize each other and growth slowed during the economic downturn, Howard Schultz is back in charge, store growth is up, and same-store sales growth was booming 8% at last count.

But with its acquisition of Keurig home brewers a few years back, Green Mountain has shown there's another high-growth way to approach the industry -- retail. It operates a similar model to SodaStream, which sells home soda makers and carbonation and syrup refills rather than home coffee brewers. SodaStream had a great deal of success selling new units in recent years, and last quarter saw consumable refills spike 38%. Green Mountain's model (Keurig sales lock in K-cup customers) seems to be a reasonably high-moat way forward in coffee retail.

3. Management

CEO Lawrence Blanford has been at the job since 2006. Before coming to Green Mountain, he ran consumer products divisions and R&D at Phillips and Maytag, respectively. Green Mountain's founder, Bob Stiller, remains chairman. It's often a good sign when founders of small, growing companies remain involved in the company. However, Buffett would certainly have to feel comfortable with management and its accounting before investing in the company.

4. Business

Coffee and coffee machines aren't particularly susceptible to technological disruption. Although Buffett might be somewhat hesitant to invest Green Mountain, whose fate, after all, is closely tied to the success of one product, he would likely appreciate the Keurig and SodaStream "razor and blade" business model, in which you make high-margin sales on providing refills that are compatible with your platform, since it's close to Gillette's, a longtime Buffett favorite.

The Foolish conclusion

So, is Green Mountain a Buffett stock? Perhaps. Although Buffett might be somewhat reluctant to invest in what he might consider to be a relatively young and unproven product concept, and he would obviously need to feel comfortable with the company's accounting first, so far the company exhibits several of the characteristics of a quintessential Buffett investment: consistent or growing earnings, high returns on equity with limited or no debt, tenured management, and a straightforward business.

If you're interested in another growth stock that our top analysts and chief investment officer picked to beat the market, you can check out The Motley Fool's Top Stock for 2012. I invite you to download this special report for a limited time by clicking here -- it's free.

At the time thisarticle was published Ilan Moscovitzdoesn't own shares of any company mentioned.The Motley Fool owns shares of Starbucks.Motley Fool newsletter serviceshave recommended buying shares of Green Mountain Coffee Roasters, SodaStream International, and Starbucks.Motley Fool newsletter serviceshave recommended writing covered calls in Starbucks and creating a lurking gator position in Green Mountain Coffee Roasters. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.