A Big Upgrade for Auto Sales

Motley Fool advisor Joe Magyer recently showed an interesting chart depicting current U.S. auto sales next to "normalized" sales. By Joe's estimates, current auto sales are about 4 million vehicles a year shy of where they should be. He explained:

The average age of cars on U.S. roads is now a record 10.6 years ... as a tough economy has forced drivers to grind out just a few more miles on their clunkers. As those vehicles get more and more expensive to fix and used car prices hover near record highs, new-vehicle demand will get pushed upward whether the economy comes along for the ride or not.

When I interviewed Mesirow Financial chief economist Diane Swonk last year, she put it another way:

I think it is important to understand that the[auto] industry is an industry where we have been scrapping vehicles faster than we have been buying them for more than four years. The pent up demand is enormous, and there is financing available, and it's one of the places where we are starting to see some movement again, and that's positive for the U.S. economy.

While the industry is beset by all kinds of problems, it's that pent-up demand that will eventually propel Ford (NYS: F) , GM (NYS: GM) , Honda (NYS: HMC) , and Toyota (NYS: TM) higher.

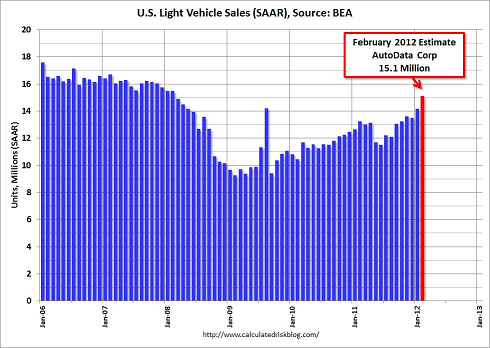

And it looks like it already is. Estimates of February auto sales came in at a seasonally adjusted annualized rate of 15.1 million. That was well ahead of expectations, and the highest rate in four years -- higher than even the artificial boom sparked by the cash-for-clunkers program in 2009:

Could this be a temporary anomaly? Sure. That's always a risk when looking at imperfect statistics. But the trend over the last year, or even two years, is clear: sales have bottomed, and are on their way back toward normal levels that are more in line with replacement cycles.

That's great news for the auto industry, and great news for the economy. It's yet another sign that things are things are moving in the right direction.

At the time thisarticle was published Fool contributorMorgan Houseldoesn't own shares in any of the companies mentioned in this article. Follow him on Twitter @TMFHousel.The Motley Fool owns shares of Ford Motor. Motley Fool newsletter services have recommended buying shares of Ford Motor and General Motors and creating a synthetic long position in Ford Motor. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.