Is Buffett Right About Housing?

"I would say the single-family homes are cheap now, too. If I had a way of buying a couple hundred thousand single-family homes ... I would load up on them ... it's a very attractive asset class now."

-- Warren Buffett on CNBC, Feb. 27

Strong words from the world's most famous opportunistic investor. What should you make of them?

Keep three things in mind. One, it's true: Nationwide, home prices are the most affordable they've been in decades. Two, most of that affordability is driven by record-low interest rates that won't last forever. And three, it depends on location, location, location.

A big reason Buffett is bullish on housing is that mortgage rates are so low. "It's a way, in effect, to short the dollar because you can take a 30-year mortgage and if it turns out your interest rate's too high, next week you refinance lower," he said. "And if it turns out it's too low, the other guy's stuck with it for 30 years."

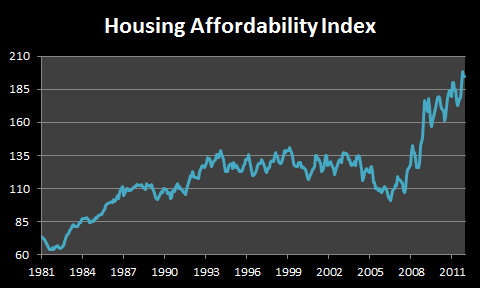

The National Association of Realtors publishes a "housing affordability index" that tracks not just housing prices, but mortgage rates, too. It shows that, indeed, home affordability is getting more attractive by the month. When Buffett talks about "a very attractive asset class," this is what he's talking about:

Source: National Association of Realtors.

But here's what's interesting. While housing affordability is setting records, home prices themselves are by no means low. Measured against median income, nationwide home prices are just now barely back to average:

Sources: S&P Case-Shiller, Census Bureau, author's calculations.

The implication of these two charts together -- record home affordability with average home prices -- should make you pause. As the saying goes, anything that can't go on forever won't. We should ask what happens when the artificial prop of record-low interest rates eventually ends and interest rates return closer to normal. When they do, home prices may fall far beyond current levels. That adds an important caveat to Buffett's call: If you can buy a home and stay put for many years, today's market looks like a steal. But if you're hoping to buy now and sell a few years down the road, tread with caution.

A quick illustration shows what I mean. When purchasing a house, buyers don't necessarily care about sticker price; what they care about is how much house they can buy at a given monthly payment. If you can afford a $1,500 monthly mortgage, and $1,500 will finance a $300,000 house, then that's your market. If, thanks to low interest rates, $1,500 can finance a $500,000 house, that's your new target price. In either case, home prices are linked to what borrowers can buy at a given budgeted monthly payment. There are other factors involved, but how much house a given monthly mortgage payment can buy is a good way to conceptualize how homes are valued.

Now think about where we are today. A 30-year mortgage averages 3.92%. In 2000, the same mortgage cost 8.5%. The difference between the two is enormous. At 3.92%, a $1,500 monthly mortgage will finance $318,000 worth of house (with a 30-year fixed-rate mortgage). At 8.5%, $1,500 a month will purchase only $195,000 worth of house. All else equal (admittedly, a bad assumption), the difference in interest rates between 2000 and today alters home affordability by more than 60%. And since 2000's interest rates were closer to "normal" than today's, the damage normal interest rates could have on current home prices should make you shudder.

Now, such worry is relevant only to those who plan on selling before long. You have to remember how Buffett thinks about real estate -- the man has lived in the same house since 1957. The average homeowner today sells after eight years. For Buffett-like buyers, price volatility after buying a home is meaningless. For those looking for an exit, price changes can be devastating. Make sure you know which side you're on. There is no shame in renting if it puts you in a better financial position. And for many, it does.

Now the standard disclosure: The nationwide housing market that analysts like me talk about is relevant to exactly no one. Measured against average income, home prices in Las Vegas are demonstrably cheap; in Seattle, they're still a little pricey; in others, it's somewhere in between. This chart, while dated, provides a decent look at home valuations by region.

What do you think about housing? Let me know in the comments section below.

At the time thisarticle was published Fool contributorMorgan Houseldoesn't own shares in any of the companies mentioned in this article. Follow him on Twitter, where he goes by@TMFHousel. His latest e-book,50 Years in the Making: The Great Recession and Its Aftermath, can be purchased on Amazon.com for your Kindle or iPad. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.