Commodity Hedging 101

In these exciting times of financial instruments, you can hedge all sorts of things 100 different ways. Right now, arguably the most important hedges across a variety of industries are derivatives focusing on the price of oil and gas. Airlines, chemical companies, utilities, and oil and gas producers all try to use a solid hedging strategy to their advantage. In order to evaluate our investments from this perspective, we should have a good understanding of the practice.

What is hedging?

Hedging helps investors lock in the price of a commodity for a set period of time. Airlines do it to lock in the lowest price for fuel, while oil producers do it to lock in the highest price. The purpose of a hedge will vary by industry, but the mechanisms are similar.

Utilizing a hedging strategy has multiple benefits, two of the most important are locking in favorable costs and reducing volatility.

Though hedging can get complicated and confusing rather quickly, most strategies employ derivatives that are a variation on swaps or collars. Swaps let investors lock in a fixed price over set periods despite changing market prices. A collar combines a long put-option position that limits potential losses with a short call-option position that limits potential gains.

Where to look

Now that we have a basic understanding of how to hedge, we need to track down the strategies that certain companies use. Not only does every company implement a different strategy, but they often present the information in a variety of ways.

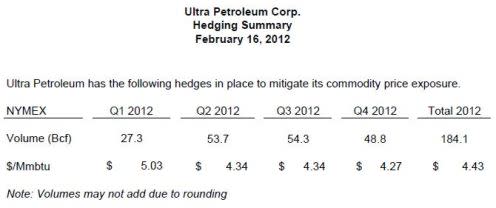

Ultra Petroleum (NYSE: UPL) posts its hedges once a quarter on its investor relations page. It's typically a simple, one-page sheet indicating the volume of production and the price it's hedged at:

Source: Ultra Petroleum.

The information here is pretty straightforward. Ultra has hedged 27.3 billion cubic feet of natural gas production at $5.03 per Mmbtu in the first quarter. It will be important to refer back to this chart when Ultra releases its first-quarter production numbers later this year to analyze the impact of its strategy.

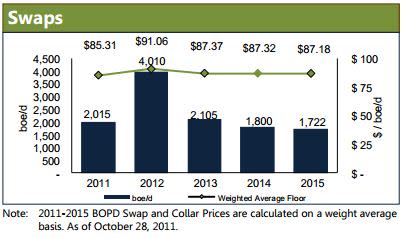

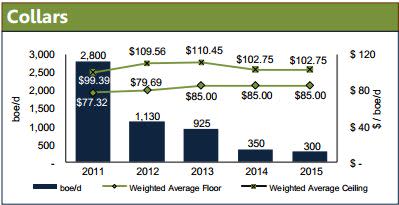

Many companies include the information in their investor presentations. It takes a bit more legwork to find, but presentations contain a lot of valuable information and are worth going through anyway. Let's take a look at the most recent presentation from Kodiak Oil & Gas (NYSE: KOG) :

Source: Kodiak Oil & Gas.

Source: Kodiak Oil & Gas.

Here we can see the exact breakdown between swaps and collars, the production volumes that are covered, and planned hedges for the future. Kodiak favored the collar in 2011 and is favoring the swap in 2012.

Now what?

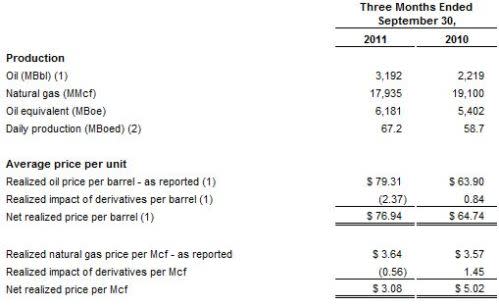

Once you track down the information, it helps to know how your company's strategy impacts its bottom line. For that, we turn to quarterly and annual statements. Let's take a look at SandRidge Energy's (NYSE: SD) third-quarter release from 2011.

Source: SandRidge Energy.

It is important to note here that "realized price" does not indicate the price that SandRidge received after hedging; rather, this is the price before derivatives come into play. Again, the $3.64 per Mcf was the average price of natural gas on the market during the period in question.

To see what SandRidge received for its gas, we continue through the report to the "Derivatives Contracts" table:

Source: SandRidge Energy.

Here we can see SandRidge hedged its natural gas at $4.62 for the third quarter, significantly higher than the $3.64 market value.

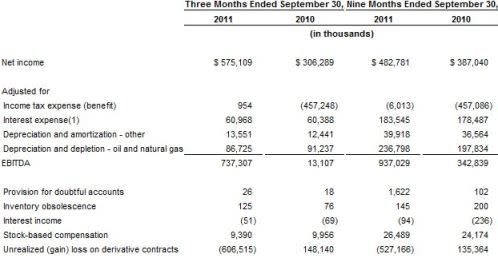

To see the final impact on the bottom line, we need to check one more chart. This time we're focusing on the one called "Reconciliation of Net Income to EBITDA and Adjusted EBITDA":

Source: SandRidge Energy.

We're looking for the line item at the very bottom of the chart that reads "Unrealized (gain) loss on derivatives contracts." Though parentheses typically indicate a negative number, in this case, it's a good sign because it means the company gained on its derivatives contracts. SandRidge's hedging position resulted in over $606 million in gains for the third quarter. Not bad, and as we can see, a much improved performance over the year prior.

Foolish takeaway

Almost every oil and gas company will mention hedging and derivatives in quarterly releases and presentations, but make no mistake, some are much better positioned than others. In these days of bottom-dwelling natural gas prices and geopolitical risk tormenting the oil industry, it may end up weighing significantly on your investment decision.

Want to hedge your bets on a company that doesn't need to worry about hedging? Click here for a special free report on what Fool analysts call "The Only Energy Stock You'll Ever Need".