Groupon Is Not a Good Deal

Daily deal provider Groupon (NAS: GRPN) recently posted an astounding 194% growth in its fourth-quarter revenue, to $506.5 million. But what's really disappointing is that the company incurred a loss of $42.7 million, surprising analysts who were expecting a profit.

That prompts me to ask: Is there a hole in its business model? I think so.

Cash drain

Although Groupon has recorded tremendous revenue growth in a number of recent quarters, profits continue to elude the company. This was mainly because of high marketing and hiring-related costs, something that prompted the company to declare in October last year that it would scale back its marketing expenses.

At first, you might think this decision would turn losses into profits. But it's really not that simple.

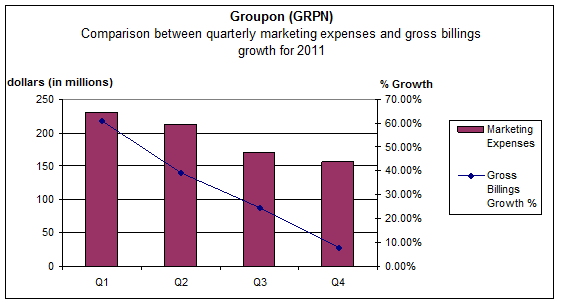

In the chart below, I have compared the growth trends in gross billings, which is the total amount the company collects from its subscribers, with marketing expenses. The correlation is obvious.

Source: Groupon's IPO prospectus, earnings press release.

Groupon has to continually shell out money to acquire the consumers it can sell the marketing deals to. Why? Customers generally have a short attention span, especially in email-based businesses such as Groupon's. In order to retain these customers, you need to sustain promotional activities until you are an established brand, even if that means running at a loss. I think Groupon's marketing expenses will continue to be high, given the stern competition in online marketing.

Lucrative deals?

Another problem with the business model is the type and value of its deals. Groupon's deals are not profitable, neither to merchants nor to customers. For merchants, especially those who offer low-margin products, instead of services such as a haircut or a gym membership, the deals do not make sense. Here's why: Groupon usually deducts a hefty 50% of sales proceeds as a commission for marketing and advertising of deals. The sad part is that it's over and above the discount. Say, for instance, if a merchant sells a product worth $40 at a 25% discount, the price would come down to $30. But after that, Groupon takes a 50% cut, leaving the merchant with just $15 to spare. That is unsustainable for sure.

For consumers, the available deals may not be the best either. First, the company's deals are mostly about discretionary items, dining and spas, and less about day-to-day needs. Given the economic scenario, I would think people are spending less and less money on such items. Customers also have a chance of getting better deals directly from the companies rather than Groupon. Where does that leave Groupon?

The Foolish bottom line

Groupon has pertinent questions to answer about the losses it is accruing. I fail to see how it would be able to churn profits with its weak business model and mammoth marketing expenses, which seem to be the necessary evil here. So, unless Groupon starts putting some money on the table, I am watching it from the sidelines.

You can add it to your watchlist to keep up with this interesting play. It's free and lets you stay on top of the latest news and analysis for your favorite companies.

At the time thisarticle was published Keki Fatakia does not hold shares in any of the companies mentioned in this article. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.