These Single-Digit P/Es Are Value Traps

This may come as a surprise, but the S&P 500 has more than doubled since its March 2009 lows. Only 3% of stocks have actually lost value since the market's lows, and more than 57% have at least doubled. With stocks in general showing little signs of slowing down, it pays now more than ever to pay attention to the few remaining values.

But that's the tricky thing with value -- it's in the eye of the beholder. Just because a stock has a P/E ratio in the single digits doesn't exactly make it cheap. According to the quick screen I ran using the Motley Fool CAPS Screener, there are 198 companies with market caps over $1 billion and single-digit P/E ratios. After some careful perusing of those 198, I came up with three that so-called "values" that you'd be better off avoiding.

Constellation Brands (NYS: STZ)

Instead of craving wine, shareholders of Constellation Brands may soon have reason to whine. Constellation Brands has seen revenue contract in each year since 2007 and is staring down another 21% fall in sales this year according to analyst estimates.

2007 | 2008 | 2009 | 2010 | 2011 | 2012 (est.) |

|---|---|---|---|---|---|

$5.22B | $3.77B | $3.66B | $3.37B | $3.33B | $2.65B |

Source: Morningstar, Yahoo! Finance, B = Billions of USD.

In Constellation's defense, its gross margin has increased in almost every year, meaning it's cutting its costs and earning more with each dollar. The company also has been selling off some of its less desirable brand names for years. Unfortunately, cost-cutting and divesting some of its weaker brand names are only going to carry it so far.

Looking at its recently reported third-quarter results, sales tumbled 27%, but more importantly, once its divested operations are backed out, organic sales fell 8%. At just 7.3 times trailing 12-month earnings Constellation might appear cheap, but it could get even cheaper if its sales trend continues in the wrong direction.

Forest Laboratories (NYS: FRX)

2012 is set to be the toughest year on record for patent expirations, with nearly $29 billion worth of yearly revenue at risk from generic competition. Forest Labs is one of those companies set to join a long list of drug makers set to fall off the patent cliff.

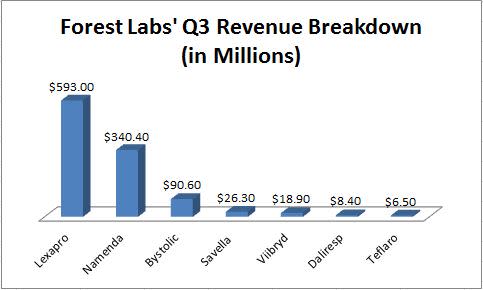

Unlike other drug makers, however, Forest Labs doesn't have a very diverse pipeline. Lexapro, a treatment for depression, and Namenda, an Alzheimer's drug, accounted for a staggering 77% of sales in the recently completed third-quarter.

Source: Forest Labs Investor Relations.

With Lexapro slated to lose exclusivity this year and Namenda in 2015, a huge chunk of Forest Labs' revenue is in serious jeopardy of dwindling over the next couple of years. And don't think generic companies aren't waiting to vulture sales -- Teva Pharmaceutical (NAS: TEVA) received the OK to sell generic Lexapro when Forest Labs' patent expires.

Forest has tried its best to pick up the expected revenue drop with the introduction of three new drugs over the past year. The concern is that its newest drugs are entering very crowded markets and taking on competitors that have far deeper wallets than Forest. Even at 8 times trailing 12-month earnings, I'd consider running in the other direction.

Research In Motion (NAS: RIMM)

This story is all about a lack of innovation. It's hard to imagine that a company at 3.6 times trailing 12-month earnings and with $1.3 billion in cash with no debt can have the amount of caution tape around it that RIM does -- but believe me, it's possible.

RIM's poor management allowed the company to get complacent with its designs which, in turn, allowed Apple (NAS: AAPL) , Samsung, and everyone not named Nokia to instantly become cooler than the BlackBerry. RIM has seen its smartphone market share fall from 44% in 2009 to just 10% in 2011 according to research firm NPD Group, while Apple's share has soared.

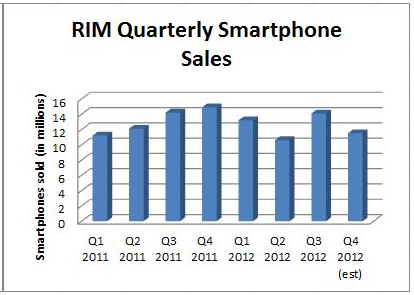

Take this side-by-side comparison to heart:

Source: Apple & RIM Investor Relations.

Apple recently reported its quarterly results which highlighted a 128% jump in iPhones sold. What did RIM do in its quarterly report? It lowered its projected smartphone production to 11-12 million units from the 14.1 million it reported in the third quarter. To top it off, RIM's former co-CEOs resigned earlier this year and were replaced with Thorstein Heins, RIM's former COO, who pledged to follow the path RIMs founders had laid and stated to analysts that "no drastic change is needed." Caveat emptor RIM shareholders, it looks like more of the same is on its way.

Foolish roundup

If value is in the eye of the beholder, either I need glasses or we need to find a different beholder. Consider these three "value" stocks better left on the shelf.

What stock do you see as the biggest value trap? Share it in the comments section below, and consider adding these three companies to your free and personalized watchlist.

Also, don't let your search for great values end here. Consider getting your very own copy of our latest special report, "The Motley Fool's Top Stock for 2012," where our chief investment officer gives you the skinny on a company he's dubbed the "Costco of Latin America." Find out which stock has him excited for free!

Add Constellation Brands to my watchlist.

Add Forest Laboratories to my watchlist.

Add Research In Motion to my watchlist.

At the time thisarticle was published Fool contributor Sean Williams has no material interest in any companies mentioned in this article. He loves a good value when he sees it. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong. The Motley Fool owns shares of Teva Pharmaceutical and Apple. Motley Fool newsletter services have recommended buying shares of Teva Pharmaceutical and Apple, as well as creating a bull call spread position in Apple. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy that feels "free" is the right price to pay for transparency.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.