Is Wall Street Back?

The problems facing Wall Street are many: from poor trading results, to the slow investment banking activity, to fee reductions required by financial reform, to flatter yield curves, and to weak demand for loans, the entire world seems to be conspiring to destroy banking revenue.

But earnings results at megabanks and regional banks alike are beginning to show a positive trend: loan growth.

Company | Fourth-Quarter Loan Growth | Fourth-Quarter Year-Over-Year Revenue Growth |

|---|---|---|

JPMorgan Chase (NYS: JPM) | 4.4% | (16%) |

Citigroup (NYS: C) | 2% | 6% |

Wells Fargo (NYS: WFC) | 1.4% | 1% |

Bank of America (NYS: BAC) | (0.6%) | (27%) |

Source: S&P Capital IQ.

Weak loan growth was perhaps the biggest impediment to sustainable growth on Wall Street. But now loans are beginning to come back for a huge number of regional and national banks -- Bank of America, which is in the process of shoring up its balance sheet, aside.

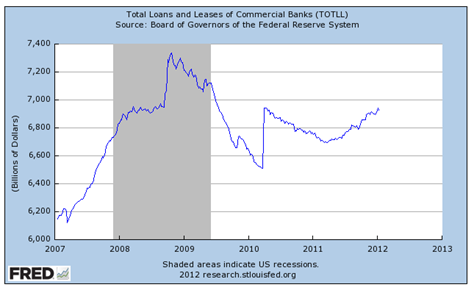

This is good news not just for banks, but for the economy as well. When the economy cratered in 2008 and early 2009, loans fell. Today, they seem to be making a comeback:

While an unhealthy chunk of these loans may consist of old housing debt that borrowers will ultimately be unable to pay back, the recent loan growth suggests that economic activity among consumers and businesses is beginning to return. That's good news for most companies and the Dow (INDEX: ^DJI) , as positive economic news in employment and manufacturing has been a big driver of the Dow's gains this year. If loan growth persists, it's an even better sign for revenue banks and cyclical industries that are economically sensitive.

If you're looking for a few promising bank stocks to consider, I'll point you to my colleague Anand Chokkavelu's top banking picks that include a stock Warren Buffett might be interested in if he could buy small stocks. He details them in our brand new free report: "The Stocks Only the Smartest Investors Are Buying." I invite you to grab a free copy.

At the time thisarticle was published Ilan Moscovitzdoesn't own shares of any company mentioned. The Motley Fool owns shares of Bank of America, JPMorgan Chase, Citigroup, and Wells Fargo and has created a covered strangle position on Wells Fargo. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.