Surging Tuition: More Than Meets the Eye

The University of California Davis made headlines last year after a group of student protesters were pepper-sprayed. You've probably seen the video. The incident went viral and became a symbol of the Occupy Wall Street movement.

Whether the pepper-spraying was right or wrong isn't a topic for this website. Why some of the students were protesting in the first place, however, seems relevant, since it has to do with one of many people's largest lifetime expenses: college tuition.

Students were protesting for all kinds of reasons, many of which you might disagree with. Most, however, were protesting a fact that I think most people find outrageous: Tuition at the University of California system has doubled over the last five years, and is set to nearly double again by 2016. In 2006, tuition at a UC school ran roughly $7,000 a year. By 2016, it could be as high as $22,000 a year. I'd probably be upset, too.

The UC system isn't alone, of course. Along with health care, college tuition has undergone a period of truly extreme inflation. Over the past quarter century, tuition has increased at nearly four times the rate of broader inflation. Between 1990 and 2010, the share of income an average American family spent on education nearly doubled. Students have largely dealt with (or fed) tuition inflation by binging on debt. In 2010, total student loans outstanding overtook credit card debt outstanding -- well over $800 billion.

We all know that tuition is rising, and it's bad. But why is it rising?

The biggest reason may be simple economics. The wage premium those with a college degree hold over those without one is growing, so the price of obtaining a degree has gone up as well.

Another reason that doesn't get enough attention, and one that explains almost all the tuition increase at UC schools, is the decline in state, local, and federal government's share of education costs. By and large, tuition is going up not because schools are raking in more money, but because subsidies are going down.

A very helpful report by the Lumina Foundation for Education helped me wrap my head around this. The report, which looks at higher education finances from 1999-2009, puts it simply: "Public sector tuition increases in 2009 were almost entirely the result of cost-shifting to replace institutional subsidies, rather than to finance new spending." Private schools faced something similar: Higher tuition has largely been used to finance grants and aid to other students, or to offset dwindling income from endowments.

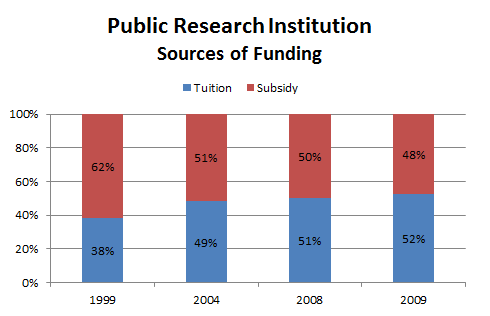

Some of the numbers are staggering. At public research institutions, tuition's share of overall school revenue jumped from 38% in 1999 to 52% in 2009:

Source: Lumina Foundation for Education.

Another way to look at this: Between 1999 and 2009, the total funding of public research institutions increased by 11%, but tuition surged more than 50%.

The same is true for private colleges, where government aid (you might be surprised how much they receive) and endowment income have dropped substantially, increasing the reliance on tuition:

Source: Lumina Foundation for Education.

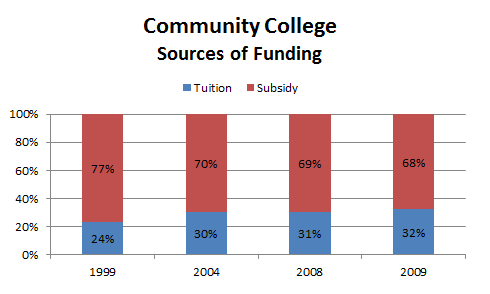

And community colleges have felt pressure, too:

Source: Lumina Foundation for Education.

Consider some actual dollar figures behind the decline in subsidies. At the UC system in California, "state funding ... has declined from a high of $3.2 billion to $2.3 billion in the economic downturn, despite rising enrollment. This year, for the first time, the UC system collects more money from students than from the state," according to TheWashington Post. In 2008, the endowments of Harvard, Yale, and Stanford all fell more than 25%. In 2010, Rice University announced it was raising tuition "to compensate for endowment losses." The school's vice president of finance explained: "Rice raises tuition every year -- as do most other schools -- and it is especially important this year, given that our endowment losses are 18%."

The most unfortunate part of this is that surging tuition costs are not, for the most part, rewarding students with a higher-quality education. Costs are simply being shifted around. And while states are slashing higher education budgets, taxpayers aren't being rewarded with lower tax rates, or even lower budget deficits; most states are cutting education spending to offset rising health-care and pension costs.

But the most dangerous part about the growing reliance on tuition is that it exacerbates inequality, making it more difficult for those of lower means to move up the economic ladder. A good college education is increasingly feasible only to those whose parents are wealthy enough to foot the bill, or those willing (often regrettably) to entomb themselves in debt. One of the biggest factors determining anyone's income is their level of education. If education is held back by an 18-year-old's ability to pay nearly $100,000 for a degree at a public university, you can connect the dots: Getting ahead becomes more about luck and less about hard work and ingenuity. No one should consider that a recipe for a healthy economy.

Looking for more like this? Check out my e-book, Everyone Believes it; Most Will be Wrong, on Amazon's Kindle bookstore. It's the best buck you'll spend all year.

Check back every Tuesday and Friday for Morgan Housel's columns on finance and economics.

At the time thisarticle was published Fool contributor Morgan Housel doesn't own shares in any of the companies mentioned in this article.Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.