TransAlta's Dividend X-ray

Not all dividends are created equal. Here, we'll do a top-to-bottom analysis of a given company to understand the quality of its dividend and how that's changed over the past five years.

The company we're looking at today is TransAlta (NYS: TAC) , which yields 5.6%.

Industry

TransAlta is an electricity producer. When the electricity market went through deregulation, utilities had to choose between being distributors or producers. TransAlta's electricity is sold wholesale and as such is unregulated. Since the company is unregulated, the stock is more volatile than the average utility company.

TransAlta Corporation Total Return Price Chart by YCharts

Dividend

To evaluate the quality of a dividend, the first thing to consider is whether the company has paid a dividend consistently over the past five years, and, if so, how much it has grown.

TransAlta's dividend has been stable at $0.29 per quarter since 2009.

Immediate safety

To understand how safe a dividend is, we use three crucial tools, the first of which is:

The interest coverage ratio, or the number of times interest is earned, which is calculated by earnings before interest and taxes, divided by interest expense. The interest coverage ratio measures a company's ability to pay the interest on its debt. A ratio less than 1.5 is questionable; a number less than 1 means the company is not bringing in enough money to cover its interest expenses.

TransAlta Corporation Times Interest Earned TTM Chart by YCharts

TransAlta covers every $1 in interest expense with nearly $4 in operating earnings.

Sustainability

The other tool we use to evaluate the safety of a dividend is:

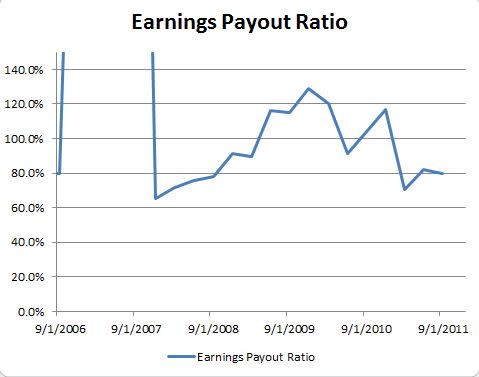

The EPS payout ratio, or dividends per share divided by earnings per share. The EPS payout ratio measures the percentage of earnings that go toward paying the dividend. A ratio greater than 80% is worrisome.

Source: S&P Capital IQ.

TransAlta's payout ratio was sky-high in 2006 before coming down to more reasonable levels. The company currently pays out roughly 80% of its earnings as dividends.

Alternatives

Source: S&P Capital IQ.

With TransAlta's volatile payout ratios, there are some alternatives in the industry. Exelon (NYS: EXC) has a yield of 4.8% and a payout ratio of 58%. El Paso Electric (NYS: EE) has a yield of 2.5% and a payout ratio of 18%. Lastly, Constellation Energy Group (NYS: CEG) has a yield of 2.4% and a payout ratio of 48%.

Another tool for better investing

Most investors don't keep tabs on their companies. That's a mistake. If you take the time to read past the headlines and crack a filing now and then, you're in a much better position to spot potential trouble early. We can help you keep tabs on your companies with My Watchlist, our free, personalized stock-tracking service.

Add TransAlta to My Watchlist.

For more dividend stock ideas, get The Motley Fool's free report, "11 Rock-Solid Dividend Stocks."

At the time thisarticle was published Follow Dan Dzombak on Twitter at @DanDzombak to check out his musings and see what articles he finds interesting. Motley Fool newsletter services have recommended buying shares of and writing a strangle position in Exelon. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.