In Choppy Waters, Ride This Dividend Wave

Back in October, reputable bond king Bill Gross proclaimed that investors should forget about double-digit returns from any asset class -- at least for the next few years. From his vantage point, the sky is darkening, and the economic outlook is bleak. Despite the choppy waters ahead, Gross reveals one industry whose dividends could provide smooth sailing for investors.

Structural hurricanes

Gross makes a bold prediction supported by convincing arguments. He describes how formerly robust economies in the developed world became "110-pound weakling[s]" as a result of three "structural hurricanes," which are paraphrased below:

Globalization has depressed domestic wages.

Technological advancements have eliminated industries producing physical products.

An aging demographic has favored savings to consumption.

Basically, outsourcing and technology worked together to crush the American job market. For a while, economic expansion continued due to policies favoring debt accumulation. This only lasted until the housing bubble collapsed in 2008. As Morgan Housel discussed recently, homeowners are scaling back on debt, or "deleveraging." Couple this with an aging population focused on saving, and you have an economy struggling to stay afloat.

Gross describes this barely buoyant economy as the "new normal" and warns of the effect on corporate profitability.

Could corporate profits sink?

Recovering from the debt binge of the past decade required policymakers to take extreme measures. The government lowered interest rates, aided troubled banks, and embraced stimulus spending. From Gross' perspective, most of these measures favored the banks and major corporations (i.e., "capital") over the average worker (i.e., "labor"). The result has been soaring corporate profits, but anemic job growth and wage gains.

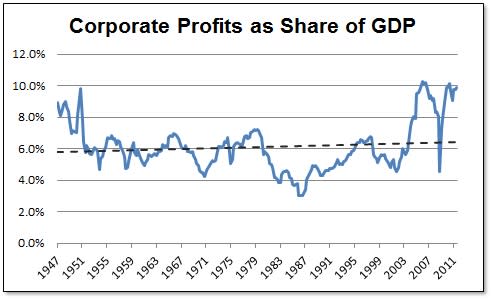

Source: Bureau of Economic Analysis.

The chart above shows corporate profits are near an all-time high of 10%. Over time, corporate earnings tend to revert to the mean, however, which is illustrated by the dotted line above. In Gross' opinion, sky-high earnings are destined to decline if labor gains do not move in unison with capital. He states, "If Main Street is unemployed and undercompensated, capital can only travel so far down Prosperity Road."

Low interest rates and increased productivity cause surging profits, but labor pays the price with 8.6% current unemployment. Gross fears a potential "labor trap" in the future where consumers curb spending due to unemployment fears, shrinking real wages, or falling home prices.

A safe haven

If the wave of corporate profits crashes down, and bonds offer no refuge, most investors will seek out healthy dividend payments. However, some dividend plays look attractive on the surface, but what lies beneath could be pretty scary.

An example might include real estate investment trusts (REITs) like ChimeraInvestment (NYS: CIM) and Annaly Capital Management (NYS: NLY) . Despite their high yields of 19.5% and 14.9%, respectively, fellow Fool John Maxfield's research exposed two companies with significant interest rate risk. Fluctuating interest rates could take a bite out of their dividend payments. Given Bill Gross' outlook for double-digit returns, I can only imagine these REITs pose considerable risk for investors.

On the other hand, Gross pointed to one industry as a bright spot in a follow-up interview -- electric utilities. He sees value in this sector relative to other stocks and bonds: "To the extent that an electric utility is a 4[%] to 4.5% yielding instrument with a 10% relatively consistent return on equity, there's some value there."

With these metrics in mind, I dove into the utilities sector and uncovered a few strong performers. The following list consists of electric utilities currently paying a dividend yield of 4% with a five-year average return on equity greater than 10%.

Company | Current Dividend Yield | 5-Year Average Return on Equity |

|---|---|---|

(NYS: AEP) | 4.7% | 11.2% |

(NYS: EXC) | 4.8% | 22.4% |

(NYS: FE) | 4.9% | 13.0% |

(NYS: PPL) | 4.8% | 15.5% |

(NYS: SO) | 4.2% | 13.4% |

Source: Yahoo! Finance and S&P Industry Survey-Electric Utilities.

Each of these companies provides a higher yield and return on equity than the utility industry averages of 4% and 9.71%, respectively. Compared with the S&P's yield of 1.96%, the utility companies' dividend payout is especially impressive. Over the past year, the market has started to catch on, driving the prices of these five stocks up 10% on average. In 2011, investors found stability in a sector that could continue to pay off in the year ahead.

Take refuge in dividends

A lukewarm economic rebound might concern individual investors, and Gross' forecast is anything but rosy. However, certain sectors like utilities can offer dependable returns on capital and strong payouts. Investors looking for a buffer against uncertainty should give high-paying dividend stocks a closer look.

If utilities don't fit the bill, check out this list of 11 dividend stocks our analysts have compiled in this Motley Fool report. The recommendations span everything from energy to health care to retail. As Warren Buffett once said, "You only find out who is swimming naked when the tide goes out." Owning a few high-paying dividend stocks can hopefully prevent that scenario for savvy investors.

At the time thisarticle was published Fool contributor Isaac Pino does not own shares in any of the companies mentioned in this article. Follow him on Twitter @TMFBoomer. The Motley Fool owns shares of Annaly Capital Management and Chimera Investment. Motley Fool newsletter services have recommended buying shares of Southern, Exelon, and Annaly Capital Management. Motley Fool newsletter services have recommended creating a write covered strangle position in Exelon. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.