Here's How NCI Building Systems May Be Failing You

Margins matter. The more NCI Building Systems (NYS: NCS) keeps of each buck it earns in revenue, the more money it has to invest in growth, fund new strategic plans, or (gasp!) distribute to shareholders. Healthy margins often separate pretenders from the best stocks in the market. That's why we check up on margins at least once a quarter in this series. I'm looking for the absolute numbers, comparisons to sector peers and competitors, and any trend that may tell me how strong NCI Building Systems' competitive position could be.

Here's the current margin snapshot for NCI Building Systems and some of its sector and industry peers and direct competitors.

NCI Building Systems | 20.4% | (1.3%) | (2.0%) |

Vulcan Materials (NYS: VMC) | 10.3% | (2.3%) | (3.5%) |

CEMEX (NYS: CX) | 28.1% | 5.8% | (13.3%) |

Masco (NYS: MAS) | 23.4% | 1.8% | (13.7%) |

Source: S&P Capital IQ. TTM = trailing 12 months.

Unfortunately, that table doesn't tell us much about where NCI Building Systems has been, or where it's going. A company with rising gross and operating margins often fuels its growth by increasing demand for its products. If it sells more units while keeping costs in check, its profitability increases. Conversely, a company with gross margins that inch downward over time is often losing out to competition, and possibly engaging in a race to the bottom on prices. If it can't make up for this problem by cutting costs -- and most companies can't -- then both the business and its shares face a decidedly bleak outlook.

Of course, over the short term, the kind of economic shocks we recently experienced can drastically affect a company's profitability. That's why I like to look at five fiscal years' worth of margins, along with the results for the trailing 12 months, the last fiscal year, and last fiscal quarter. You can't always reach a hard conclusion about your company's health, but you can better understand what to expect, and what to watch.

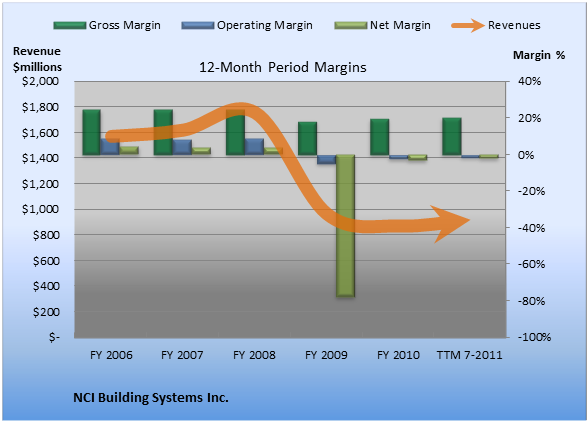

Here's the margin picture for NCI Building Systems over the past few years.

Source: S&P Capital IQ. Dollar amounts in millions. FY = fiscal year. TTM = trailing 12 months.

Because of seasonality in some businesses, the numbers for the last period on the right -- the TTM figures -- aren't always comparable to the FY results preceding them. To compare quarterly margins to their prior-year levels, consult this chart.

Source: S&P Capital IQ. Dollar amounts in millions. FQ = fiscal quarter.

Here's how the stats break down:

Over the past five years, gross margin peaked at 24.8% and averaged 22.4%. Operating margin peaked at 8.9% and averaged 3.7%. Net margin peaked at 4.7% and averaged -13.6%.

TTM gross margin is 20.4%, 200 basis points worse than the five-year average. TTM operating margin is -1.3%, 500 basis points worse than the five-year average. TTM net margin is -2%, 1,160 basis points better than the five-year average.

With recent TTM operating margins below historical averages, NCI Building Systems has some work to do.

If you take the time to read past the headlines and crack a filing now and then, you're probably ahead of 95% of the market's individual investors. To stay ahead, learn more about how I use analysis like this to help me uncover the best returns in the stock market. Got an opinion on the margins at NCI Building Systems? Let us know in the comments below.

Add NCI Building Systems to My Watchlist.

Add Vulcan Materials to My Watchlist.

Add CEMEX to My Watchlist.

Add Masco to My Watchlist.

At the time thisarticle was published

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.