Energy's Unlikely Hot Spot

There's only one place in the country where oil production is growing so fast that infrastructure can't keep up. It's the beautiful state of North Dakota, the same state that boasts the lowest unemployment rate in the country.

North Dakota has long been a quiet state filled with hardworking people who would rather talk about the weather than what's going on on Wall Street. But investors on Wall Street have certainly taken notice of how fast companies have been able to exploit oil shale and grow oil production in the state. The numbers are hard to ignore.

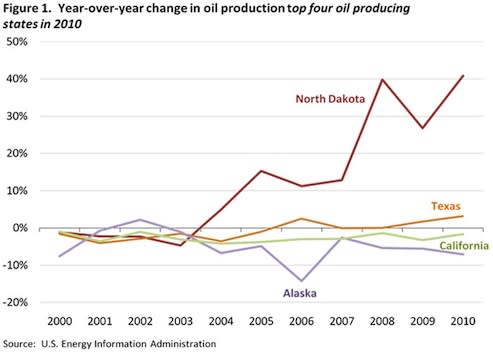

Below is a graph showing the annual growth in oil production in North Dakota, Texas, California, and Alaska. North Dakota easily blows away the other states in growth since 2005 and the pace of growth is increasing.

Growth in oil production hasn't come without tough times. Workers are being paid a mint, but can't find places to live. Housing growth hasn't nearly kept pace with the unexpected population growth, and infrastructure like roads aren't holding up well, either.

But I'm sure any state would love to have a problem like too few houses and too many jobs.

Playing the oil boom

So who is responsible for this immense growth in oil production? There are some major players holding thousands of square miles of acreage in the Bakken shale play, and their stakes seem to be continually growing.

Kodiak Oil & Gas (NYS: KOG) | 155,000 net acres |

Continental Resources (NYS: CLR) | 901,000 net acres |

Whiting Petroleum (NYS: WLL) | 532,266 net acres |

Statoil (NYS: STO) | 375,000 net acres |

Source: Company filings and press releases.

These companies are not only growing revenue quickly; reserves are growing as well. There is debate about how much oil is actually in the Bakken shale play, but the estimates are growing. In 2008, the USGS estimated there were 3.0 billion to 4.3 billion barrels of technically recoverable oil. Recent estimates put that at 18 billion barrels and some have estimated the area holds well over 100 billion barrels of oil.

North Dakota's energy hot spot is only getting hotter and as technology improves, the amount of oil coming from the area will continue to grow.

One of the biggest opportunities in the Bakken shale play is transporting oil. The roads in the Williston Basin weren't built to hold trucks transporting oil day and night, which leaves an opportunity for pipelines. Enbridge Energy Partners (NYS: EEP) is expanding its capacity in the area and its parent Enbridge (NYS: ENB) has more capacity in the pipeline.

No matter how you want to play the growth in oil production in North Dakota, it's an area that should not be ignored as the country works to decrease its need for foreign oil.

At the time thisarticle was published Fool contributorTravis Hoiumdoes not have a position in any company mentioned. You can follow Travis on Twitter at@FlushDrawFool, check out hispersonal stock holdingsor follow his CAPS picks atTMFFlushDraw.Motley Fool newsletter serviceshave recommended buying shares of Statoil A. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.