A Brief History of Intel's Returns

Despite constant attempts by analysts and the media to complicate the basics of investing, there are really only three ways a stock can create value for its shareholders:

Dividends.

Earnings growth.

Changes in valuation multiples.

In this series, we drill down on one company's returns to see how each of those three has played a role over the past decade. Step on up, Intel (NAS: INTC) .

Intel shares returned 3% over the past decade. How'd they get there?

Dividends kept things above water. Without dividends, shares returned negative 16% over the past 10 years.

Earnings growth was surprisingly strong. Intel's normalized earnings per share increased by an average of 11% per year from 2001 until today -- well above the market average. Part of the growth was fueled by a reduction in the number of shares outstanding, which fell by 20% during the period.

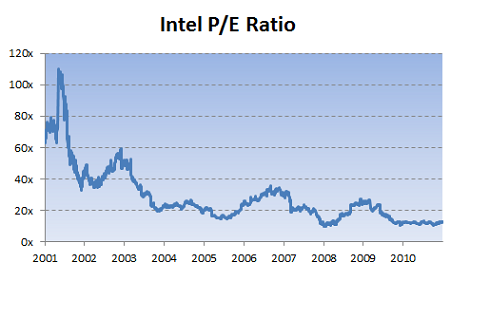

But if Intel's earnings were so strong, why were shareholder returns so pitiful? This chart explains why:

Source: S&P Capital IQ.

A lot of investors bemoan the fact that large-cap stocks haven't gone anywhere for the past decade. They shouldn't -- the outcome was entirely predictable, as a chart of Intel's P/E ratio shows. Those who bought shares at 70 times earnings received what they deserved -- poor returns.

The collapse of Intel's valuation multiple, from about 70 to 12 in 10 years, prevented all of the company's strong earnings growth from showing up in shareholder returns. The same phenomenon has taken place at Microsoft (NAS: MSFT) and Hewlett-Packard (NYS: HPQ) ; returns over the past decade have been lackluster, yet earnings growth over the period has been solid. The disappointing returns were due entirely to sky-high valuations 10 years ago. The same goes for Intel.

The good news is that at about 12 times earnings, Intel's situation couldn't be in a more different spot today than it was 10 years ago. Rather than grossly overvalued, it's not hard to make the case that shares are now severely undervalued. Combine that with a 3.5% dividend yield, and the coming decade should be much, much better for Intel shareholders than the past one.

Why is this stuff worth paying attention to? It's important to know not only how much a stock has returned, but where those returns came from. Sometimes earnings grow, but the market isn't willing to pay as much for those earnings. Sometimes earnings fall, but the market bids shares higher anyway. Sometimes both earnings and earnings multiples stay flat, but a company generates returns through dividends. Sometimes everything works together, and returns surge. Sometimes nothing works and they crash. All tell a different story about the state of a company. Not knowing why something happened can be just as dangerous as not knowing that something happened at all.

Add Intel to My Watchlist.

At the time thisarticle was published Fool contributor Morgan Housel owns shares of Intel and Microsoft. Follow him on Twitter @TMFHousel. The Motley Fool owns shares of Intel and Microsoft. The Fool owns shares of and has bought calls on Intel. Motley Fool newsletter services have recommended buying shares of Microsoft and Intel, as well as creating bull call spread positions in Intel and Microsoft. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.