Should You Buy What Insiders Are Selling?

October was a ridiculously good month if you were bullish on equities. For the month, the S&P 500 rose nearly 11%, while the Dow Jones Industrial Average (INDEX: ^DJI) tacked on an impressive 9.5%. What's really odd about October's gains is they came during what it normally one of the worst performance months on record for the indexes.

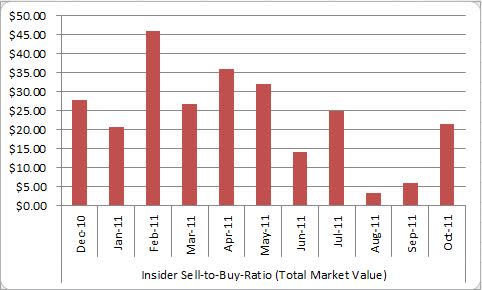

But as can be expected with a month of near-record gains, we've seen a resurgence in insiders willing to part with their shares. In fact, October marked the first time we've seen insider selling outpacing purchases by more than a 20-to-1 margin since July. Here's a closer look at the staggering amount of insider selling shareholders have been subjected to over the past 10 months:

Source: Thomson Reuters.

Keep in mind that insiders can have a wide array of reasons for parting with their shares. Sometimes, it can be something as benign as tax-loss selling, or perhaps to simply generate revenue for everyday expenses in their lives. Other times however -- and this is the real concern -- insider selling represents a bet from management that a stocks better days could indeed be behind it.

While I can't say for certain whether or not what we witnessed in October was another bet from insiders that this market is getting frothy, I can say that some notable names were on the insider selling list. Here are the six companies that had the most insider selling for the week that ended Nov. 4, according to the Wall Street Journal:

Company | Insider Shares Sold | Market Value |

|---|---|---|

Oracle (NAS: ORCL) | 1,400,000 | $46,410,840 |

AutoZone (NYS: AZO) | 109,915 | $35,948,684 |

CapitalSource (NYS: CSE) | 5,165,078 | $31,625,768 |

Danaher (NYS: DHR) | 518,568 | $25,250,763 |

Intel (NYS: INTC) | 979,895 | $24,294,647 |

Johnson & Johnson (NYS: JNJ) | 298,300 | $19,493,905 |

Source: The Wall Street Journal, market value data as of Nov. 4.

As I said before, the selling we've seen in these companies could be completely normal. Then again, for a company like CapitalSource, it's confusing to see the company aggressively purchasing shares while insiders are busy dumping them.

Unfortunately, we may never know whether insiders sold because they thought shares would fall soon. But my gut instinct tells me that after such a large run-up last month, corporate executives are more than willing to hand you over their shares at higher prices. The question is: Does Main Street want Wall Street's shares? I predict we'll have an answer to this question in a few months.

In the meantime, let's have your input on the matter. Does the large increase in insider selling in October curb or change your investing habits, or will you just captain your ship as normal? Share your thoughts in the comments section below.

At the time thisarticle was published Fool contributorSean Williamshas no material interest in any companies mentioned in this article. He gives a wag of his finger at insiders who relentlessly sell common stock. You can follow him on CAPS under the screen nameTMFUltraLong, track every pick he makes under the screen nameTrackUltraLong, and check him out on Twitter, where he goes by the handle@TMFUltraLong.The Motley Fool owns shares of Oracle, Johnson & Johnson, Intel, and CapitalSource, and has bought calls on Intel.Motley Fool newsletter serviceshave recommended buying shares of Johnson & Johnson and Intel, as well as creating a diagonal call position in Johnson & Johnson and a bull call spread in Intel.Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has adisclosure policythat believes in putting investors at the front of the line.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.