IBM and Oracle: 2 Competing Bets on IT

The information technology industry has been experiencing a golden age. Corporate IT spending is at an all-time high, and IT firms have been setting new highs in revenue and earnings. In addition to prosperity, any profitable market also brings ferocious competition. Such is the case with IBM (NYS: IBM) and Oracle (NAS: ORCL) .

The two companies have generally been separated by the hardware/software barrier, but the IT market has recently brought more competitors looking for a bigger piece of the pie. This has made it harder for IT companies to win the big corporate contracts they need to remain profitable. Responding to tougher times, Oracle and IBM have been making efforts to expand into new territory. They've been stepping on each other's toes recently; especially in areas like database services and cloud computing. What started out as typical technology hostilities has evolved into a full-blown war.

The IT theater of war

Despite their cutthroat competition, the sheer size and expansive potential of the IT industry is temporarily allowing both of these enormous companies to grow fairly rapidly. Looking at their latest quarterly reports, one can see that IBM grew revenues by 8% in the last year and boosted GAAP earnings by 13%. Not to be outdone by its rival, Oracle grew revenue by 12% and earnings by a whopping 34%. In an environment where many other companies struggle to expand at all, IBM and Oracle are making it look easy.

The battlefronts: Asia-Pacific, EMEA, and the Americas

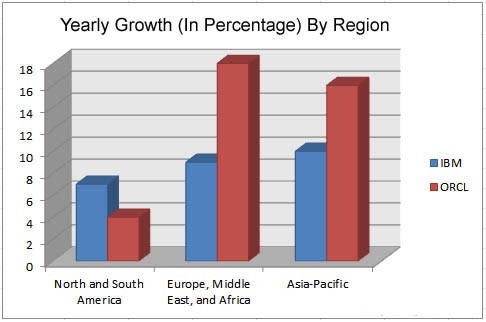

Every war has its fronts. IBM and Oracle both have a presence in every major region of the world, and are continuously trying to undercut the competition while expanding their own customer base. How are they faring? To get a sense, let's take a look at the growth rates of both companies' revenue from October 2010 to October 2011 by region.

Source: Calculated data from the IBM Q3 2011 earnings release and the Oracle Q1 2012 report.

As you can see, Oracle has handily beat IBM in terms of growth in every major region of the globe. What's really impressive here is the margin by which Oracle surpassed IBM's revenue growth in the Asia-Pacific region since 2010. With a huge unmet demand for IT services provided by firms like Oracle and IBM, Asia will likely remain the fastest-growing market for information technology for years to come. Since Oracle seems to be scooping up market share a lot faster, we'll give it the nod over IBM in regional growth.

Hardware and software

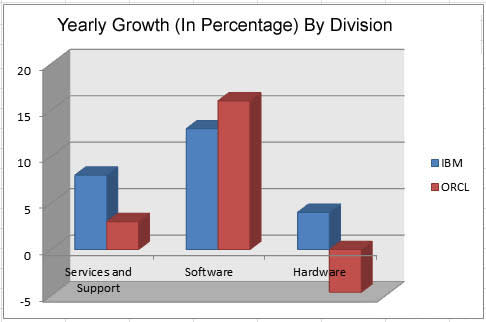

Every war needs weapons, and the two rivals have no shortage of them. IBM and Oracle have been significantly ramping up hardware and software product lines. IT hardware -- which has traditionally been (and still is) dominated by IBM -- has been experiencing especially strong crowding in recent years. Dell (NAS: DELL) and Hewlett-Packard (NYS: HPQ) , in an attempt to get out of the PC market, have been ramping up efforts to expand their IT divisions. This has had somewhat adverse effects on IBM's prospects in hardware as market share becomes highly sought-after.

For the most part, Oracle still dominates business software, and has moved itself forward into hardware in a big way. Its acquisition of Sun Microsystems and its new datacenters have been crowding the market even further. Oracle's market performance in hardware has been quite lackluster so far, but the company's extremely profitable software licenses have carried the company's earnings sufficiently.

Source: Calculated constant-currency data from the IBM Q3 2011 earnings release, and the Oracle Q1 2012 report.

Noting that Oracle didn't have a hardware division in Q1 2011, the company still managed to beat IBM in constant-currency revenue growth through software and services revenue growth. The extent to which IBM's software division is outperforming its hardware division implies that the real growth in the IT market is coming from software, which is Oracle's specialty.

Now what?

IBM is the more stable investment due to its longer history and larger market cap, but it lacks the growth positioning that Oracle has. Due to a higher worldwide growth rate and the higher profit margins, it can be inferred that the real growth for big IT companies will be in software licenses. By region, it seems that Asia is key to the information technology market.

Oracle looks to be the frontrunner in this race, and continues to eat IBM's market share in various subindustries. Relative to IBM, which has really become an overpriced favorite of Wall Street, still trading near its 52-week high, Oracle is a much better way to play the IT market. Shares of Oracle have been hit hard since summer, but they've been bouncing back with ferocity. It might not be long before they head to fresh 52-week highs given their unbelievable expansion.

The Motley Fool recently compiled a special report - "13 High-Yielding Stocks to Buy Today" -- detailing potential opportunities in the market. It's totally free to our readers. With developed markets looking as bleak as they do, you need an edge to your investing research. Access your free copy today to get the leg up you need.

At the time thisarticle was published The Motley Fool owns shares of International Business Machines and Oracle. Motley Fool newsletter services have recommended buying shares of Dell. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Fool contributor Brian Wilson doesn't own shares of any company mentioned. You can email him at brian.wilson@hyperioncapitalresearch.com. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.