Where Can Nokia Still Find Growth?

In today's world, most companies span several regions and sell across the world. As Foolish colleague Morgan Housel notes, 10 years ago, less than a third of S&P 500 revenue came from abroad. Today, that makes up more than half of the S&P 500's growth.

And that number is growing. The truth is, investors regularly underestimate how much demand comes from abroad. More importantly, for large, multinational corporations that have already established a presence in their home markets, much of their future growth comes from abroad.

With that in mind, today we're looking at Nokia (NYS: NOK) . We'll examine not only where its sales and earnings come from, but also how its sales abroad have changed over time.

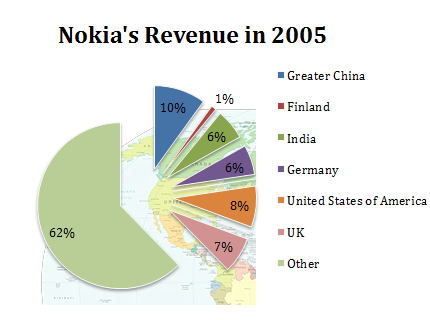

Where Nokia's sales were five years ago

Five years ago, Nokia produced 10% of its profits within China. While its domestic market -- Finland -- is too small to move the needle, it also reported a combined 13% of its sales from within Germany and the United Kingdom. Its other large reported domestic market, the United States, kicked in another 8% of sales.

Source: S&P Capital IQ.

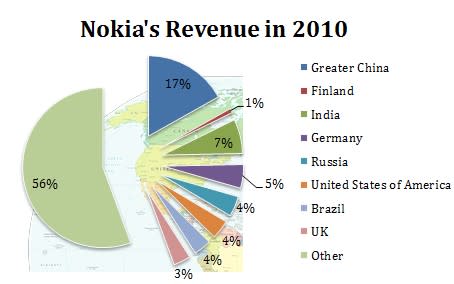

Where Nokia's sales are today

Today, you see the rapid shift in Nokia's business to emerging markets where, cheaper phones are far more popular. In 2010, the United States was down to 4% of sales and is now a smaller market for Nokia than Russia. Sales to the United Kingdom fell off a cliff as tastes shifted to Apple's (NAS: AAPL) iPhone, Research In Motion's (NAS: RIMM) BlackBerry, and Google's (NAS: GOOG) Android. Combined, reported developed countries like Finland, the United States, Germany, and the U.K. now contribute only about 13% of company sales. Other developed countries get lumped into Nokia's massive "other" category, but the trend is clear: Countries like China and India are still buying up cheaper Nokia phones while their high-end smartphone business languishes and has caused massive share loss in wealthier countries.

Source: S&P Capital IQ.

Segment | 5-Year Sales Growth |

|---|---|

Greater China | 138% |

Finland | 27% |

India | 65% |

Germany | 15% |

United States of America | (33%) |

UK | (31%) |

Source: S&P Capital IQ.

Competitor checkup

One last point to check is how Nokia's footprint compares with some of its peers.

Company | Geography With Most Sales | Percent of Sales |

|---|---|---|

Nokia | Greater China | 17% |

Apple | Americas* | 41%* |

Motorola Mobility (NYS: MMI) | United States | 65% |

Research in Motion | United States | 39% |

Source: S&P Capital IQ.

*Divides retail stores evenly between regions on a percent-of-sales basis.

Nokia still has the most diversified geographic reach of its competitors, but these numbers can be deceiving. Apple, for example, now collects 16% of its sales from China. Since Apple's China's sales are growing so fast, it's not hard to imagine the company's percent of sales to China surpassing Nokia's 17% total from last year when it reports upcoming quarters. More to the point, Nokia is selling a high mix of cheap phones on the lower end of the market while Apple is selling high-end iPhones with huge profit margins.

Motorola still predominately sells to the United States; however, with Google buying the company out, you could see an increasing international skew. Finally, Research In Motion claims the United States as its top geography, but its sales to the U.S. are falling. Its future increasingly lies in markets like the United Kingdom and Latin America.

Keep searching

If you're looking to stay updated on Nokia or any other companies listed above, make sure to add them to our free watchlist service, My Watchlist. It's free, and it helps you constantly stay updated on news and analysis on your favorite companies.

Add Nokia to My Watchlist.

Add Motorola Mobility Holdings to My Watchlist.

Add Google to My Watchlist.

Add Apple to My Watchlist.

Add Research In Motion to My Watchlist.

At the time thisarticle was published Eric Bleekerowns shares of no companies listed above. You canfollow him on Twitterto see all of his technology and market commentary. The Motley Fool owns shares of Apple and Google.Motley Fool newsletter serviceshave recommended buying shares of Google and Apple and creating a bull call spread position in Apple. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.