Can Tibco Conquer the World?

In today's world, most companies span several regions and sell across the world. As Foolish colleague Morgan Housel notes, 10 years ago, less than a third of S&P 500 revenue came from abroad. Today, that makes up more than half of the S&P 500's growth.

And that number is growing. The truth is, investors regularly underestimate how much demand comes from abroad. More importantly, for large, multinational corporations that have already established a presence in their home markets, much of their future growth comes from abroad.

With that in mind, today we're looking at Tibco (NAS: TIBX) . We'll examine not only where its sales and earnings come from, but also how its sales abroad have changed over time.

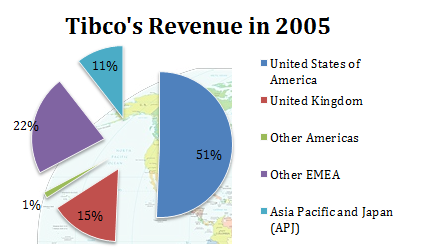

Where Tibco's sales were five years ago

Five years ago, Tibco collected 51% of its sales from the United States market, with the United Kingdom kicking in another 15% of sales.

Source: S&P Capital IQ.

Where Tibco's sales are today

Today, while America is still Tibco's largest market by far, the United Kingdom has moved all the way down to just 9% of companywide sales as other European countries grew in significance.

Source: S&P Capital IQ.

Segment | 1-Year Sales Growth | 5-Year Sales Growth |

|---|---|---|

United States | 32% | 63% |

United Kingdom | 12% | 3% |

Other Americas | 10% | 569% |

Other EMEA | 5% | 107% |

Asia Pacific and Japan (APJ) | 45% | 52% |

Source: S&P Capital IQ.

In the preceding chart, I included not only a one-year sales growth figure to show how sharply different geographies have rebounded from their lows in 2009, but also a five-year figure to illustrate longer-term growth trends.

The company has done a respectable job growing sales in its home American market not only recently but across the past half-decade as well. Elsewhere in the Americas, growth has been enormous in recent years. Sales to Canada and Latin America are still just 5% of total sales, but the company appears to have gained a lot of traction in these markets.

Finally, while the Asian market has below average five-year growth, there's quite a bit of opportunity in this area. Other IT competitors like IBM (NYS: IBM) have been trumpeting their growth in this region, so there's ample opportunity for Tibco to expand across Asia.

Competitor checkup

One last point to check is how Tibco's footprint compares with some of its technology peers and industry rivals.

Company | Geography With Most Sales | Percent of Sales |

|---|---|---|

Tibco | United States | 49% |

IBM | Americas | 43% |

Hewlett-Packard (NYS: HPQ) | United States | 35% |

Qlik Technologies (NAS: QLIK) | Europe | 60% |

Source: S&P Capital IQ.

As I mentioned, IBM is at the forefront of the pack when it comes to international expansion. In the company's aggressive 2015 road map, it lists "growth" markets as a key area for driving profits forward. Also, in nearly every earnings report, IBM lists BRIC country growth that far exceeds companywide totals.

Qlik, a cloud-focused data analysis company, is interesting in that most of its sales are in Europe. The company is based in Radnor, Pa., but was founded in Sweeden back in 1993. As the company is able to gain more of a foothold in the American market, that could give it a powerful avenue for growth.

Keep searching

If you're looking to stay updated on Tibco or any other companies listed above, make sure to add them to our free watchlist service, My Watchlist. It's free, and it helps you constantly stay updated on news and analysis on your favorite companies.

Add Tibco Software to My Watchlist.

Add Qlik Technologies to My Watchlist.

Add IBM to My Watchlist.

Add Hewlett-Packard to My Watchlist.

At the time thisarticle was published Eric Bleekerowns shares of no companies listed above. You canfollow him on Twitterto see all of his technology and market commentary. The Motley Fool owns shares of IBM.Motley Fool newsletter serviceshave recommended buying shares of Tibco Software and Qlik Technologies. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.