Can International Opportunities Drive salesforce.com Forward?

In today's world, most companies span several regions and sell across the world. As Foolish colleague Morgan Housel notes, 10 years ago, less than a third of S&P 500 revenue came from abroad. Today, that makes up more than half of the S&P 500's growth.

And that number is growing. The truth is, investors regularly underestimate how much demand comes from abroad. More importantly, for large, multinational corporations that have already established a presence in their home markets, much of their future growth comes from abroad.

With that in mind, today we're looking at salesforce.com (NYS: CRM) . We'll examine not only where its sales and earnings come from, but also how its sales abroad have changed over time.

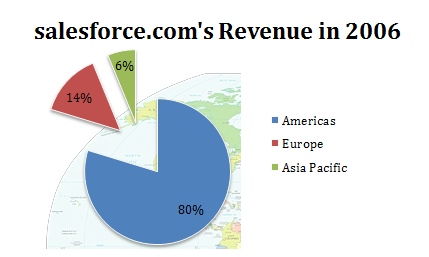

Where salesforce.com's sales were five years ago

Five years ago, salesforce.com was a much smaller company that it is today, but it still collected a whopping 80% of its sales from the American market.

Source: S&P Capital IQ.

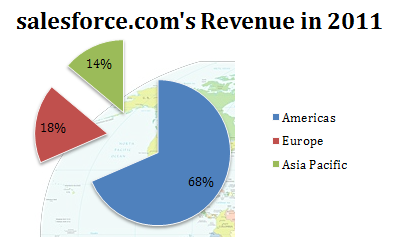

Where salesforce.com's sales are today

Today, while the Americas is still salesforce.com's largest market by far, the influence of both Europe and Asian markets is increasingly being felt.

Source: S&P Capital IQ.

Segment | 5-Year Sales Growth |

|---|---|

Americas | 360% |

Europe | 570% |

Asia-Pacific | 1,095% |

Company-Wide | 435% |

Source: S&P Capital IQ.

The first obvious note is that as a whole, growth for the company has been absolutely massive across the past five years. The second very important note is that salesforce.com is managing to make inroads around the world. While other software peers have difficulty profiting in emerging markets where piracy runs rampant, salesforce.com's cloud focus will help it mitigate this threat. Software isn't installed locally and easily and pirated; instead, users have to log in to use the company's products through the Web. Being able to sell to the next generation of start-ups around the globe that don't want the expensive burden of their own infrastructure is the very opportunity salesforce.com must strike to justify its lofty valuation.

Competitor checkup

One last point to check is how salesforce's footprint compares with some of its Internet peers and industry rivals.

Company | Geography With Most Sales | Percent of Sales |

|---|---|---|

salesforce.com | Americas | 68% |

Microsoft (NAS: MSFT) | United States | 54% |

Oracle (NAS: ORCL) | United States | 43%* |

SuccessFactors (NYS: SFSF) | United States | 78% |

Source: S&P Capital IQ.

Companies like Oracle and Microsoft can present a complex challenge when analyzing their geographic reach, as large multinationals might book sales in the United States even though end revenue is really abroad. The important point to consider is that packaged software is easily pirated, which can restrict international growth rates. Looking at Oracle, it'll face a tough battle against salesforce.com in emerging markets where a new breed of companies is emerging. In the United States, Oracle has already wrapped up many of the Fortune 500-size companies. However, as the megacorporations of the next generation emerge in countries like China, they'll be more apt to choose salesforce.com in their infancy.

A final note is comparing salesforce.com with its smaller Internet services peer SuccessFactors. The company still collects 78% of its revenue domestically, so if it can follow salesforce.com's path that number should be dramatically whittled down in the coming years as international business expands.

Keep searching

If you're looking to stay updated on salesforce.com or any other companies listed above, make sure to add them to our free watchlist service, My Watchlist. It's free, and it helps you constantly stay updated on news and analysis on your favorite companies.

Add salesforce.com to My Watchlist.

Add SuccessFactors to My Watchlist.

Add Oracle to My Watchlist.

Add Microsoft to My Watchlist.

At the time thisarticle was published Eric Bleekerowns shares of no companies listed above. You canfollow him on Twitterto see all of his technology and market commentary. The Motley Fool owns shares of Microsoft and Oracle.Motley Fool newsletter serviceshave recommended buying shares of salesforce.com and Microsoft, creating a bull call spread position in Microsoft, and shorting salesforce.com. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.