Where Is Honeywell Finding Its Growth?

In today's world, most companies span several regions and sell across the world. As Foolish colleague Morgan Housel notes, 10 years ago, less than a third of S&P 500 revenue came from abroad. Today, that makes up more than half of the S&P 500's growth.

And that number is growing. The truth is, investors regularly underestimate how much demand comes from abroad. More importantly, for large, multinational corporations that have already established a presence in their home markets, much of their future growth comes from abroad.

With that in mind, today we're looking at Honeywell (NYS: HON) . We'll examine not only where its sales and earnings come from, but how its sales abroad have changed over time.

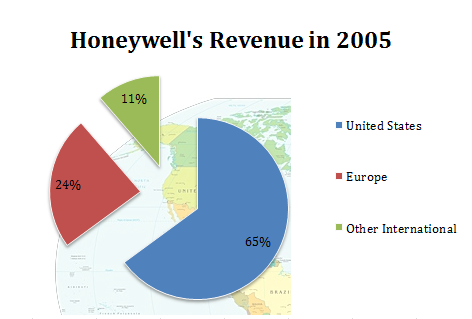

Where Honeywell's sales were five years ago

Five years ago, Honeywell produced 65% of its sales within the United States.

Source: S&P Capital IQ.

Where Honeywell's sales are today

Today, America is still Honeywell's largest market, but its influence is shrinking. While the United States still contributes 59% of sales, domestic sales growth lags far behind other regions.

Source: S&P Capital IQ.

Segment | 5-Year Revenue Growth |

|---|---|

United States | 9% |

Europe | 28% |

Other International | 69% |

Company Total | 21% |

Source: S&P Capital IQ.

The emergence of international sales comes largely because Honeywell is shifting its products away from the defense-heavy aerospace segment and toward areas like specialty materials that would be popular in international markets. Here's a breakdown of revenue growth within Honeywell's segments as well.

Segment | 5-Year Revenue Growth |

|---|---|

Aerospace | 2% |

Automation and Control Solutions | 46% |

Specialty Materials | 46% |

Transportation Systems | (7%) |

Source: S&P Capital IQ.

Competitor checkup

One last point to check is how Honeywell's footprint compares with some of its peers':

Company | Geography With Most Sales | Percent of Sales |

|---|---|---|

Honeywell | United States | 59% |

Boeing (NYS: BA) | United States | 59% |

Raytheon (NYS: RTN) | United States | 77% |

United Technologies (NYS: UTX) | United States | 53% |

Source: S&P Capital IQ.

Compared to its peers, Honeywell is pretty comparable in terms of its international exposure. Boeing sees the same 59% of its sales from the United States, but that figure was 71% just five years ago. That shrinking U.S. reliance is the result of booming demand in its commercial aerospace division.

Raytheon sees its sales far more concentrated to the United States, but it's still a more geographically diversified bet compared with a peer like Lockheed Martin (NYS: LMT) , which reports 100% of its sales domestically. Interestingly, while United Technologies has the greatest percent of international sales in the group, its sales percentage to the United States has actually risen over the past five years.

Keep searching

If you're looking to stay updated on Honeywell or any other companies listed above, make sure to add them to our free watchlist service, My Watchlist. It's free, and it helps you constantly stay updated on news and analysis on your favorite companies.

Add Honeywell to My Watchlist.

Add Boeing to My Watchlist.

Add Raytheon to My Watchlist.

Add United Technologies to My Watchlist.

At the time thisarticle was published Eric Bleeker owns shares of no companies listed above. You can follow him on Twitter to see all of his technology and market commentary. The Motley Fool owns shares of Raytheon and Lockheed Martin. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.