McDonald's: Looking at the International Opportunity

In today's world, most companies span several regions and sell across the world. As Foolish colleague Morgan Housel notes, 10 years ago, less than a third of S&P 500 revenue came from overseas. Today, more than half of the S&P 500's growth comes from o verseas.

And that number is growing. The truth is, investors regularly underestimate how much demand comes from abroad. More importantly, for large, multinational corporations that have already established a presence in their home markets, much of their future growth comes from abroad.

With that in mind, today we're looking at McDonald's (NYS: MCD) . We'll examine not only where its sales and earnings come from, but how its sales abroad have changed over time.

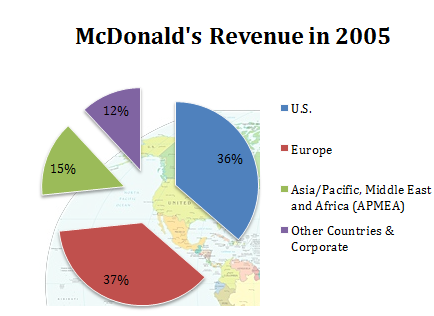

Where McDonald's sales were five years ago

Five years ago time, America and Europe combined to account for 73% of McDonald's sales while business in "other countries" (largely Latin America) and Asia, the Middle East, and Africa combined to account for 27% of sales.

Source: S&P Capital IQ.

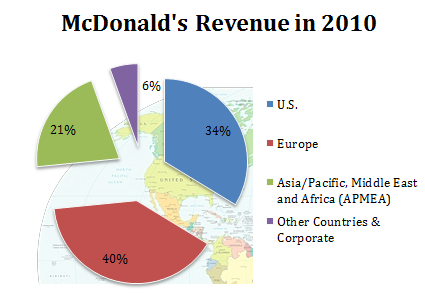

Where McDonald's sales are today

Today, America and Europe account for 73% of sales while the rest of the world accounts for 27%. If you noted that's exactly the same as 2005, you're correct. That might shock investors who are used to stories of McDonald's being a pre-eminent and growing brand in emerging markets across the globe. However, the more you dig into McDonald's sales, the more you realize the international change the company is undergoing.

Source: S&P Capital IQ.

The first change to note is the shrinking of sales to "other countries." The shrinking sales to this segment are the result of McDonald's selling its struggling Latin American operations. In 2007, the company tried refocusing on its business by selling off its Latin American locations and spinning off Chipotle Mexican Grill (NYS: CMG) . McDonald's locations in that region are now publicly traded under Arcos Dorados (NYS: ARCO) . Despite the loss of sales to the region, the deal will likely still be a success for McDonald's because the company continues to receive franchise fees and sales royalties from locations owned by Arcos Dorados.

Further drilling down on growth in developing markets, while Asia, Middle East, and Africa grew from 15% to 21% of sales, that only tells a small part of their success story. What's even more stunning is the tremendous profit growth seen in these regions. While McDonald's as a whole has been incredibly successful at expanding its margins, these emerging markets are leading the way.

Segment | 5-Year Revenue Growth | 5-Year Profit Growth |

|---|---|---|

U.S. | 17% | 42% |

Europe | 35% | 93% |

Asia/Pacific, Middle East and Africa (APMEA) | 80% | 248% |

S&P Capital IQ.

Competitor checkup

One last point to check is how McDonald's footprint compares to some of its peers:

Company | Geography With Most Sales | Percent of Sales |

|---|---|---|

McDonald's | Europe | 40% |

Starbucks (NAS: SBUX) | United States | 71% |

Dunkin' Brands (NAS: DNKN) | United States | 77% |

Yum! Brands (NYS: YUM) | China | 37% |

Source: S&P Capital IQ.

Compared to its peers, McDonald's has an iconic international brand that's hard to beat. While Starbucks has overseas aspirations, the vast majority of its sales are still from within the United States. Dunkin' Brands is almost entirely a pure play on the United States.

For investors looking to key in on the opportunity presented by Chinese consumers, Yum! Brands is an exciting opportunity. The company -- which owns properties such as KFC and Taco Bell -- has seen sales in the country grow 220% over the past five years. China is now the company's largest market in terms of both sales and profits.

Keep searching

If you're looking to stay updated on McDonald's, or any other companies listed above, make sure to add them to our free watchlist service, My Watchlist. It's free, and it helps you constantly stay updated on news and analysis on your favorite companies.

Add McDonald's to My Watchlist.

Add Yum! Brands to My Watchlist.

Add Starbucks to My Watchlist.

Add Dunkin' Brands Group to My Watchlist.

Add Arcos Dorados to My Watchlist.

At the time thisarticle was published Eric Bleeker owns shares of no companies listed above. You can follow him on Twitter to see all of his technology and market commentary.The Motley Fool owns shares of Starbucks, Yum! Brands, and Chipotle Mexican Grill. Motley Fool newsletter services have recommended buying shares of Starbucks, McDonald's, Chipotle Mexican Grill, and Yum! Brands. Motley Fool newsletter services have recommended creating a position in Chipotle Mexican Grill. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.