A Brief History of Clorox's Returns

Despite constant attempts by analysts and the media to complicate the basics of investing, there are really only three ways a stock can create value for its shareholders:

Dividends.

Earnings growth.

Changes in valuation multiples.

In this series, we drill down on one company's returns to see how each of those three has played a role over the past decade. Step on up, Clorox (NYS: CLX) .

Clorox shares returned 145% over the past decade. How'd they get there?

Dividends accounted for about one-third of it. Without dividends, shares returned 90% over the past ten years.

Earnings growth was strong during the period. Clorox's earnings per share grew at an average of 11.3% per year over the past ten years. That's well above the market average, and puts the company in the top tier of large-cap companies. A lot of the earnings-per-share growth was driven by a reduction in the number of shares outstanding, which fell by 42% over the period.

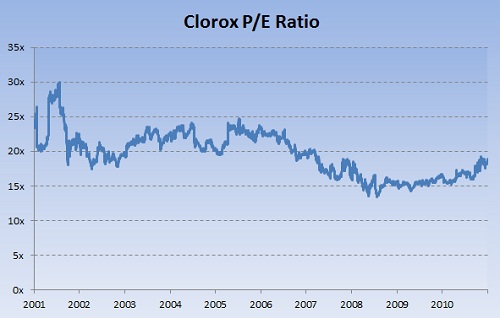

And have a look at the valuation multiple:

Source: S&P Capital IQ.

Clorox's P/E ratio has indeed come down since the early 2000s, which was the tail end of the dot-com bubble. But for the most part, it's been fairly stable, at least compared with other large-cap companies. Procter & Gamble's (NYS: PG) P/E ratio, for example, has fallen by about half over the past ten years. Why such a big fall? Because its P/E ratio was higher than Clorox's to begin with, and thus had to fall more to come closer to a sustainable average. That alone is why Clorox shares have actually been a better investment despite slower earnings growth, which underscores one of the most imperative things to remember in investing: Starting valuation determines future returns.

Why is this stuff worth paying attention to? It's important to know not only how much a stock has returned, but where those returns came from. Sometimes earnings grow, but the market isn't willing to pay as much for those earnings. Sometimes earnings fall, but the market bids shares higher anyway. Sometimes both earnings and earnings multiples stay flat, but a company generates returns through dividends. Sometimes everything works together, and returns surge. Sometimes nothing works and they crash. All tell a different story about the state of a company. Not knowing why something happened can be just as dangerous as not knowing that something happened at all.

Add Clorox to My Watchlist.

At the time thisarticle was published

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.